Every individual or a corporate is required by law to submit taxes within due dates. These laws have been framed under various statutes in India. One of the laws in the Income-tax Act 1961 has prescribed advance tax payment due dates & TDS payment due dates. It is mandatory to adhere to the said dates to avoid penalties, late fees and worst-case prosecution.

ADVANCE TAX PAYMENT DUE DATES

If during the year Income Tax Liability of a taxpayer is going to be more than Rs. 10,000, then the taxpayer must deposit Advance tax.

“Advance tax shall be payable during a financial year in every case where the amount of such tax payable by the assessee during that year, as computed in accordance with the provisions of this Chapter, is ten thousand rupees or more.” – Section 208

| Due Date | Amount of Tax Payable |

| On or before 15th June | 15% of the Advance tax |

| On or before 15th September | 45% of the Advance tax |

| On or before 15th December | 75% of the Advance tax |

| On or before 15th March | 100% of the Advance tax |

Note: For taxpayers who opted for Presumptive taxation scheme u/s 44AD and 44ADA, the above dates are not necessary to comply they can pay their tax on or before the 15th of March without any interest and penalty.

Not liable to pay advance tax

1. Only an individual who is aged 60 years or more has been exempted from payment of advance tax as per the provision of Section 207 of the income tax act.

2. A person whose income during the year does not attract tax liability of Rs. 10,000 or more also does not need to deposit advance tax. This limit is prescribed by section 208 of the act.

3. Individuals whose income is chargeable under the head salaries, advance tax payment due dates are not applicable for them. However, if any income received by employees of the foreign entity on whose income TDS is not deducted. Then, such individuals must pay the self-assessment tax in advance.

TDS Payment due date

Every person is liable to deduct tax from the payment being made if it is mentioned under the provisions of Income Tax Act 1961. Therefore, many employers, tenants, and banks deduct tax at the time of the making of the payment.

These persons deducting tax must deposit the same with the Income-tax Department. The TDS Payment due date for depositing tax collected are as follows:

| Month | Due Date |

| April | 7th of May |

| May | 7th of June |

| June | 7th of July |

| July | 7th of August |

| August | 7th of September |

| September | 7th of October |

| October | 7th of November |

| November | 7th of December |

| December | 7th of January |

| January | 7th of February |

| February | 7th of March |

| March | 30th of April |

Interest on missing TDS Payment Due Date and Penalty

Section 201(1A) charges interest on missing TDS Payment Due Date. The interest is charged on overdue payment of TDS to the department. Additionally, it is charged on late deduction of tax i.e. tax was not deducted on the due date.

Penalty for Late Deduction of TDS

If any person does not deduct TDS at the time such deduction was due, then interest is levied for late deduction of TDS. The interest is charged at 1% per month until such failure to TDS continues. TDS deducted in part of the month is taken as a full month, for calculation of interest and penalty.

Late Payment of TDS and penalty

Every person must pay TDS within prescribed timelines. Interest is charged on late payment of TDS. Such interest is chargeable at 1.5% per month. Interest will be calculated from the date TDS was deducted till the date such late payment exists. TDS payment is made in any part will be calculated as a full month, for calculating interest or penalty.

Payment of Tax Online?

You can pay your taxes online by going on a tin-nsdl website or clicking on this link: https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

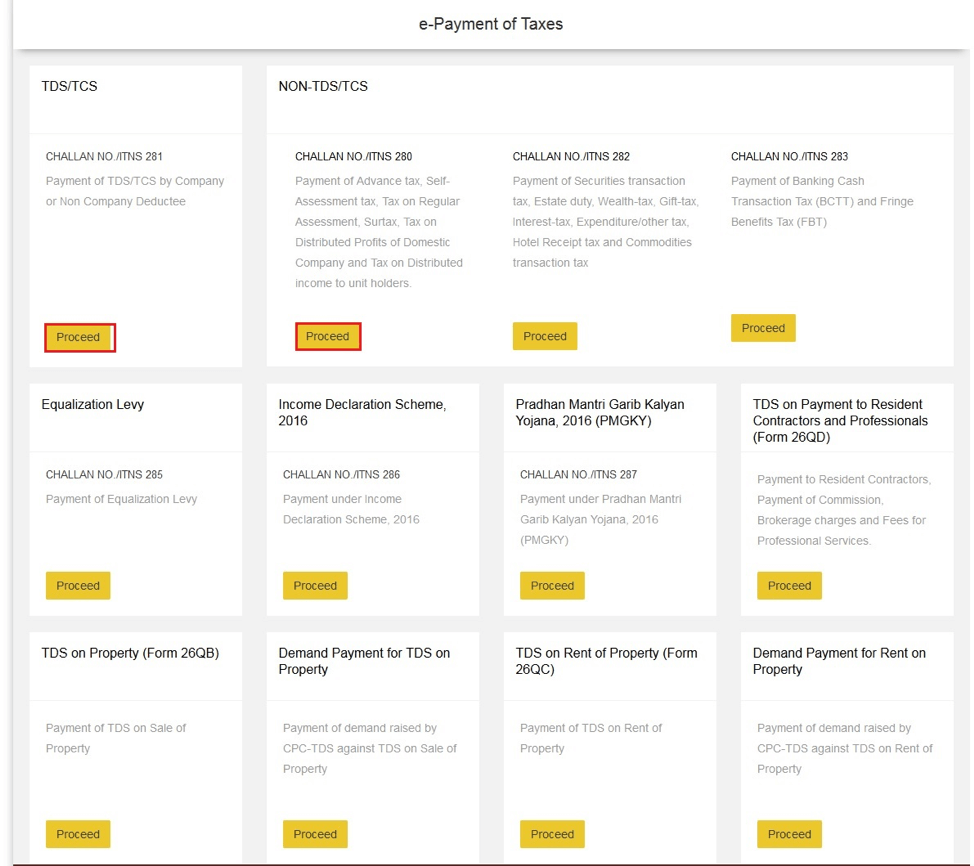

On clicking the above link, the following screen will appear:

Step 1: Select the challan as per the type of tax you must pay. For paying Tax deducted you must select Challan no. 281 or for paying self-assessment tax you have to select challan no. 280.  Step 2: If you select Challan no 281 for payment of tax deducted, the following screen will appear

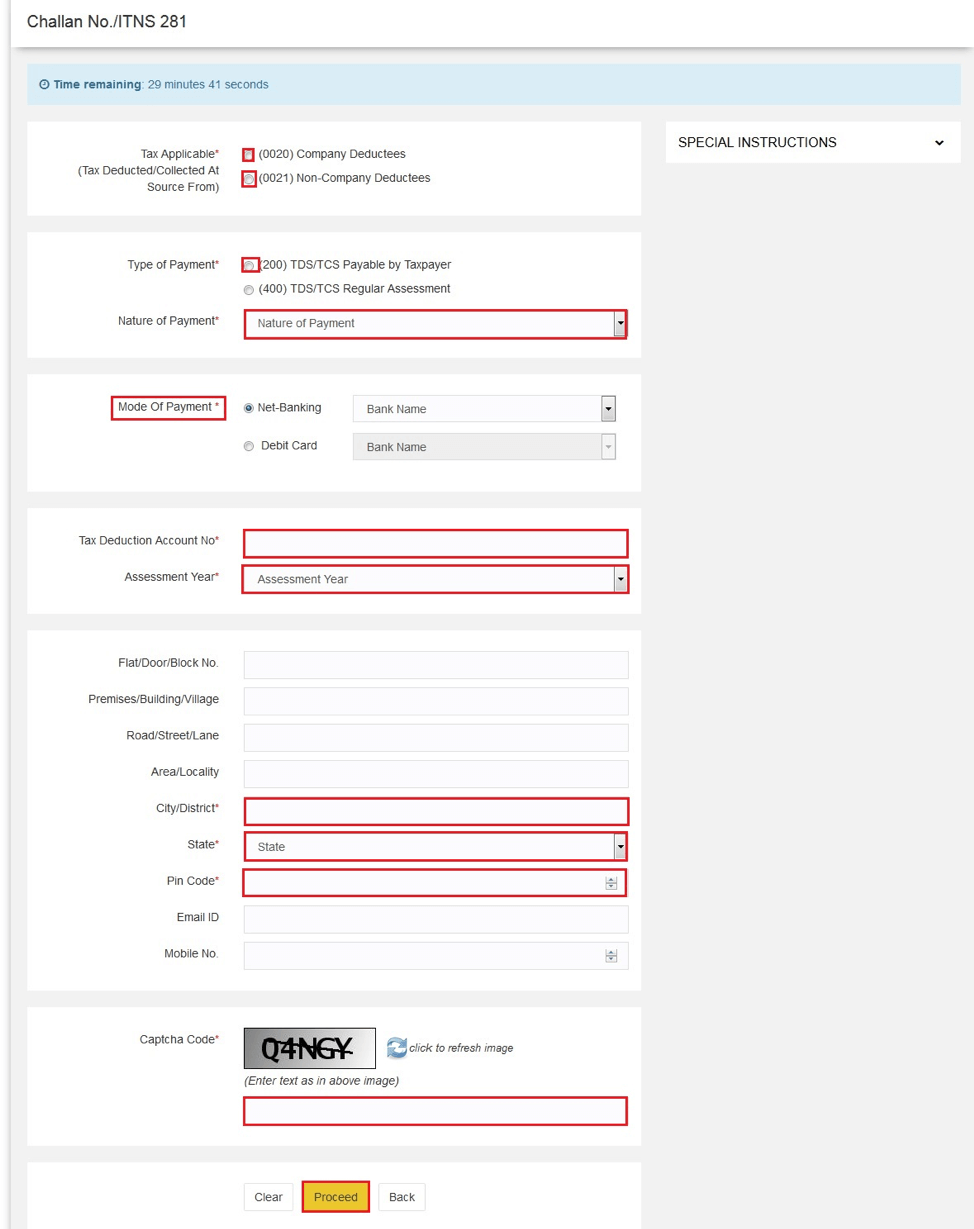

Step 2: If you select Challan no 281 for payment of tax deducted, the following screen will appear

Step3: On the above page, select all the details relevant to you and fill the form accordingly.

- Select whether you are a company deductee or non-company deductee

- Select the type of payment:

- 200 if you are paying tax normally

- 400 if you are paying tax after assessment

- Select the “Nature of Payment” for which tax was deducted

- Select your mode of payment

- A TAN number is necessary for deducting tax, enter your TAN

- Select your relevant assessment year.

- It is mandatory to add your City/District, State and Pin code.

- Enter the captcha and click on the “Proceed” button

Note: Same procedure is to be followed while filling Challan no 280

FAQs: Advance Tax, TDS – Payment due dates

1. Do we have to deduct tax on salary paid to employees?

Yes, if you are paying salary to any person of more than Rs. 250000 than you must deduct tax at the time of payment of salary as per tax slab rates. It has to be paid as per TDS payment due dates to Government.

2. I am receiving a salary from a foreign entity directly in my bank account, do I have to pay income tax?

Yes, if you are receiving a salary from a foreign company and your tax is not deducted then, you will have to pay advance tax. It has to be paid as per Advance tax payment due dates to Government.

3. What will happen if I do not deposit tax deducted?

If you do not deposit tax deducted, you will have to pay interest on such amount @ 1.5% per month.

4. Which challan is used for payment of tax deducted at source?

You will have to pay tax in Challan no 281.

5. Which challan is used for the payment of advance tax?

For paying the advance tax you will have to use challan no. 280.

StairFirst is an e-service platform which provides company registration, corporate compliances, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details

1 comment

[…] understand Meaning of TDS in Income tax with examples. Also, we will focus on liability to deduct TDS, due dates, TDS returns, certificates and rates of […]