There are various deductions, allowances, reliefs, or rebates provided by the Income Tax Department. These reliefs are provided to ease the burden of tax on small taxpayers. Also, the intent is to encourage more people to file their income tax returns. One of these rebates is rebate under section 87A of Income tax Act.

The rebate was introduced by the Finance Ministry in the year 2013. In the beginning, rebate was allowed only to individuals whose income during the previous year was up to Rs. 3,50,000. The quantum of deduction used to be a maximum of Rs. 2,500. However, the same is changed from FY 2019-20. Now, the limit of the rebate is raised to Rs. 12,500. Further details of the rebate are discussed in the article below.

REBATE UNDER SECTION 87A OF INCOME TAX ACT

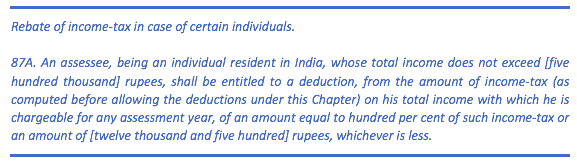

Section 87A as contained in the Income Tax Act 1961, is as follows:

Detailed Analysis of rebate under section 87A of Income tax Act

Detailed Analysis of rebate under section 87A of Income tax Act

By reading the above section we can conclude the following:

- Rebate is available only to individuals

- The person availing the rebate must be resident of India

- The total income should not be more than Rs. 500,000.

- The maximum rebate allowed is Rs. 12,500.

From FY 19-20 the quantum rebate under section 87A of Income tax Act is increased. This rebate is applicable for those individuals with income not more than Rs. 5,00,000 during the previous year. The quantum of deduction shall be lower of

- 100% of the tax due; or

- 12,500

Who is Qualified to avail rebate under section 87A of Income tax Act?

After reading the above section and analysis we can safely conclude, rebate under section 87A of Income tax Act is available for following:

- The person who wants to claim this deduction must be an individual

- The individual can claim a rebate if he was a resident of India during the year

- The total taxable income of the resident individual should not be more than Rs. 5,00,000 during the year

- The amount allowed as a rebate to the resident individual shall be the lower of the following:

- Tax liability; or

- 12,500

What is a Resident Indian?

As per the provisions of the Income Tax Act, a resident individual is a person who has stayed in India for a minimum period as specified under the Act. The period prescribed by the act is one of the following.

- An individual who has spent 182 or more days during the relevant Financial Year in India.

- An individual who has spent the following days in India

- 60 days or more during the relevant financial year, and

- 365 days or more during the last 4 years preceding the relevant Financial Year

For example, For FY 2019-20 Mr. A, to be considered as resident of India must have stayed in India for the following period:

1st Option: Mr. A should have stayed in India for 182 days or more during the FY 2019-20

2nd Option: Mr. A should have stayed in India for the following periods:

-

- 60 days or more during the FY 2019-20

- Total 365 days or more during the last 4 financial years i.e. FY 18-19, FY 17-18, FY 16-17 and FY 15-16

We can better understand the rebate with the following example:

Mr. A, is a resident individual whose annual income during the year is Rs. 600,000. Mr. A has invested Rs. 1,00,000 towards the public provident fund (PPF). What will be the tax liability of Mr. A during the FY 2019-20?

Solution:

In the above scenario, Mr. A total income is Rs. 600,000. The investment made by Mr. A in PPF is Rs. 1,00,000. Since the amount invested in the Public provident fund scheme is eligible for deduction under section 80C. The deduction available under 80C is a maximum of Rs. 150,000. Since the amount invested under PPF is Rs. 100,000 so the allowable deduction shall be restricted to Rs. 100,000 only.

The below table can make you understand the rebate under section 87A of Income tax Act

| Computation of Income | |||

| Particulars | Amount (Rs.) | ||

| Gross Total Income | 6,00,000 | ||

| Less: Deduction u/s 80C | 1,00,000 | ||

| Net Total Income | 5,00,000 | ||

| Tax @5% | 12,500 | ||

| Less: Rebate u/s 87A | 12,500 | ||

| Net Tax Payable | NIL | ||

FREQUENTLY ASKED QUESTIONS (FAQs)

1. Can a person claim rebate even after tax is deducted by the employer?

Yes, you can claim rebate under section 87A of Income tax Act even if your tax is already deducted. However, you must file the Income Tax Return to claim a rebate.

2. Non-resident living in Australia, having an income of Rs. 4,50,000. How do I avail of rebate under section 87A?

No, rebate u/s 87A is only available to the resident individual.

3. Can a HUF or Partnership firm claim rebate u/s 87A?

No, as per the provision of sec 87A only a resident individual or HUF can claim this rebate. Therefore, a Partnership firm and a HUF cannot claim rebate under this provision.

4. What is the maximum limit a person can claim as rebate under section 87A of Income tax Act?

A person can claim the rebate of up to Rs. 12,500 during the financial year.

5. What is the net total income on which the rebate is allowed to a person?

Any individual can claim rebate u/s 87A if his net annual income during the year is not more than Rs. 500,000.

6. I have a net annual income of Rs. 5,10,000, can I claim rebate u/s 87A?

No, if the net income of individuals during the year is more than Rs. 500,000, the rebate shall not be available.

StairFirst is an e-service platform which provides Company Registration, GST Registration, GST Returns, Corporate Compliances, Income Tax-related and other professional services related to startups / new and old businesses. Contact Us for details