Return can be described as a statement of information relating to business activities detailing transactions carried out during the period. GST Return is a statement of information containing details of your sales and tax collected on such sales, purchases and tax paid on such purchases. GST returns are filed to inform the GST department of activities being carried out by the businesses as well as for payment of tax liabilities. It is important to know where and how to file GST returns? In this article, we will discuss due dates, forms and step by step process to file monthly GST returns i.e. GSTR-1 and GSTR-3B.

Types of GST returns & how to file GST returns?

Chapter IX of the CGST Act [Section 37 to 48] and sections 150 & 123 prescribe provisions of filing of returns under the Act.

| Section | Type of Returns | Particulars | Due Date |

| Section 37 | GSTR-1 | GSTR-1 is to be filed monthly. It contains details of all outward supplies made during the period including the purchases on which reverse charge is paid. Also details of all credit notes, debit notes and revised invoices must be furnished. | 11th of the following month, but maybe extended by notification from GST Council |

| GSTR-2A | GSTR-2A is a read-only document.

It contains details of all goods or services purchased by the person during the period from a registered supplier. It reflects the details of GSTR-1 furnished by the suppliers of goods and services. It is up to the recipient of goods or services to accept, reject or modify. |

Between 10 and 15th | |

| GSTR-2 | GSTR-2 contains details with regards to the purchase of goods or services made by the recipient during the period.

GSTR-2 is linked with GSTR-2A and thus contains details mentioned in GSTR-2A. |

Suspended by Government | |

| Section 39 | GSTR-3 | Contains details of all outward and inward supplies | Suspended By Government |

| Rule 61(5) of CGST Rules | GSTR-3B | Summary of Inward & Outward Supplies, with details of ITC to be claimed.

Payment of Tax is made in this return |

By the 20th of the following month. |

| Section 39 | GSTR-4/ CMP-08 | For dealers registered under Composition Scheme | Quarterly; by 18th day from the end of Quarter |

| Section 39 | GSTR-5 | Return for a Non-Resident foreign taxable person | Monthly, 20th of the next month |

| Section 39 | GSTR-6 | To be filed by Input Service Distributor

Details of ITC received and distributed. Details of all documents issued for the distribution of ITC |

13th of the next month |

| Section 39 | GSTR-7 | Filed by the person deducting TDS under GST | 10th of the next month |

| Section 52(4) | GSTR-8 | To be filed by E-commerce operators along with details of tax collected | 10th of the next month |

| Section 44 | GSTR-9 | Annual Return to be filed by Normal Taxpayer

|

Annually, 31st December of next financial year |

| GSTR-9A | Annual Return a taxpayer registered under the composition levy anytime during the year | Annually, 31st December of next financial year | |

| GSTR-9C | Filed by all persons registered under GST whose turnover is more than Rs. 2 crores.

It is a reconciliation statement. A Chartered Accountant or Cost Accountant can conduct such an audit. |

Annually, 31st December of next financial year | |

| Sec 45 | GSTR-10 | Final Return; When GST registration is canceled or order for cancellation is passed. | Within 3 months of the date of cancellation or date of cancellation order, whichever is later. |

| Rule 82 of the CGST Rules | GSTR-11 | Details of purchase made by a person holding UIN (Unique Identification Number) to claim a refund on a purchase made | Monthly; 28th of the month following the month for which statement is filed |

How to file GST return : GSTR-1

The GST department has introduced the process of filing GST returns online. You can file your GSTR-1 online, the process is simple, efficient and smooth. GSTR-1 contains details of all sales made during the month and details of purchases made on a reverse charge basis. It is filed monthly if your turnover is less than Rs. 1.5 crores you have the option to file GSTR-1 quarterly. Otherwise, you need to file this GST return every month. We will follow step by step process to understand how to file GST returns?

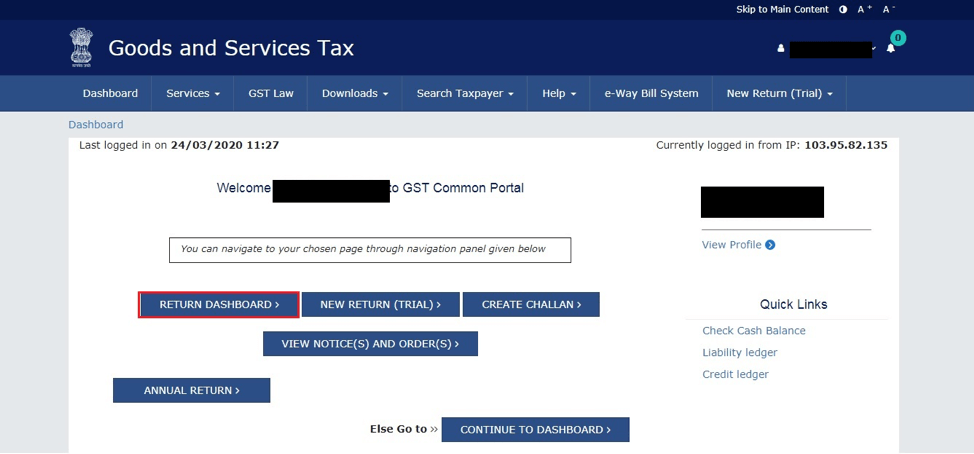

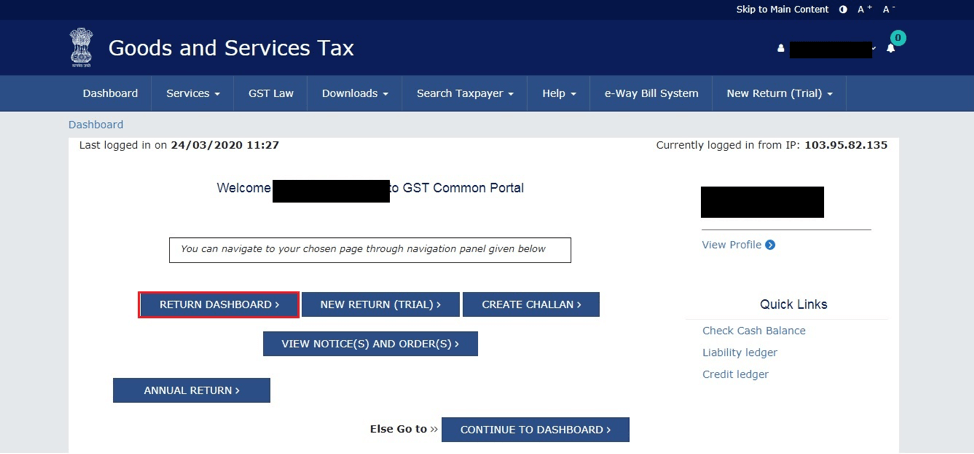

Step 1: To file a return, you must log in on www.gst.gov.in. The following screen shall appear, click on “Return Dashboard” in the red box.

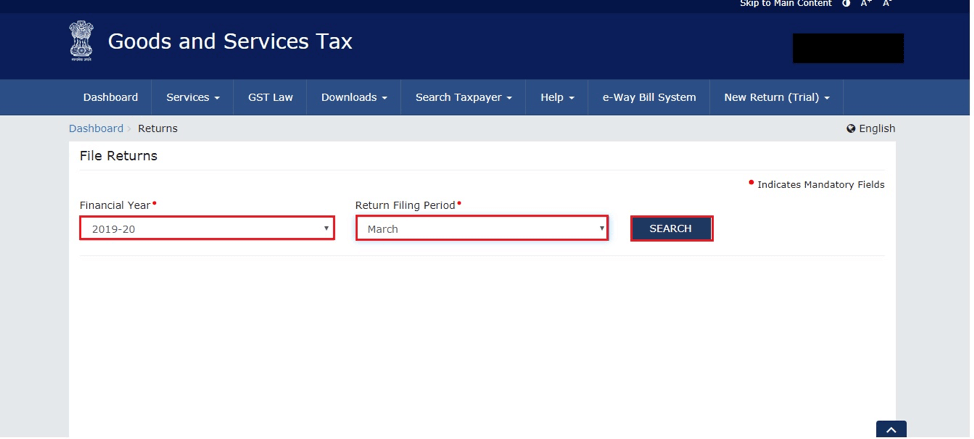

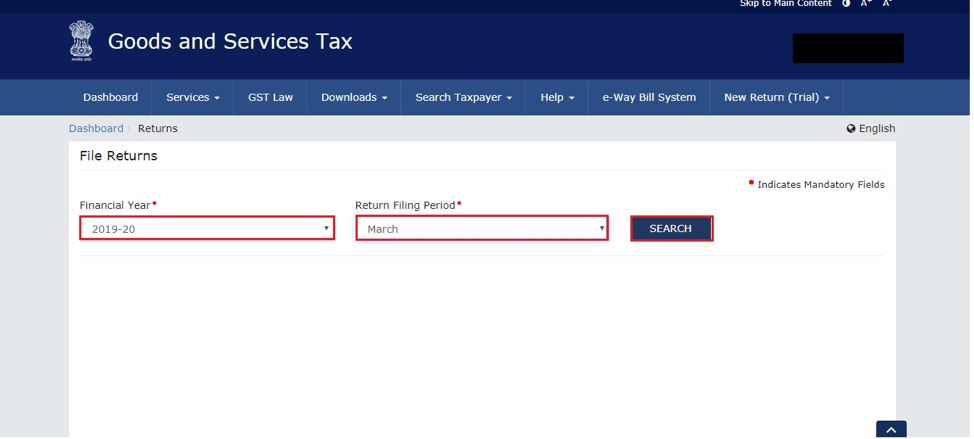

Step 2: After you click on the “Return Dashboard” button, the following screen will appear.

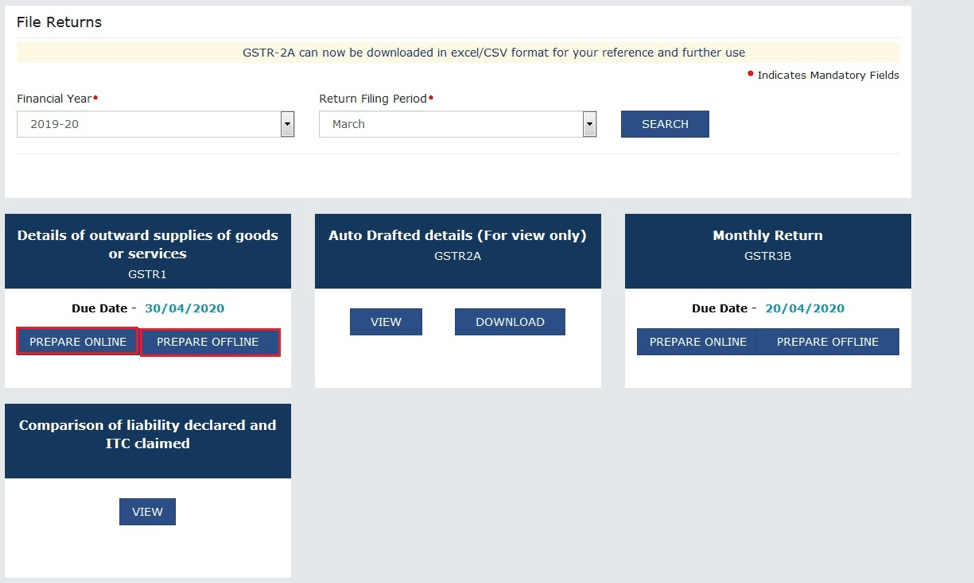

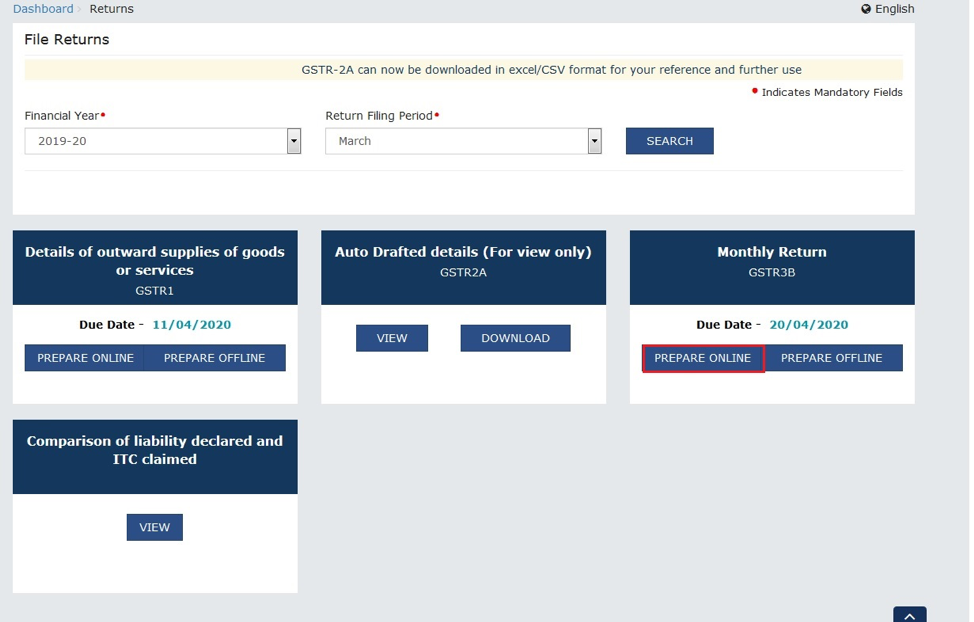

Step 3: In highlighted red boxes, select the year and month for which you want to file your return and click on the “Search” button. The following screen will appear showing status and due date of returns to be filed.

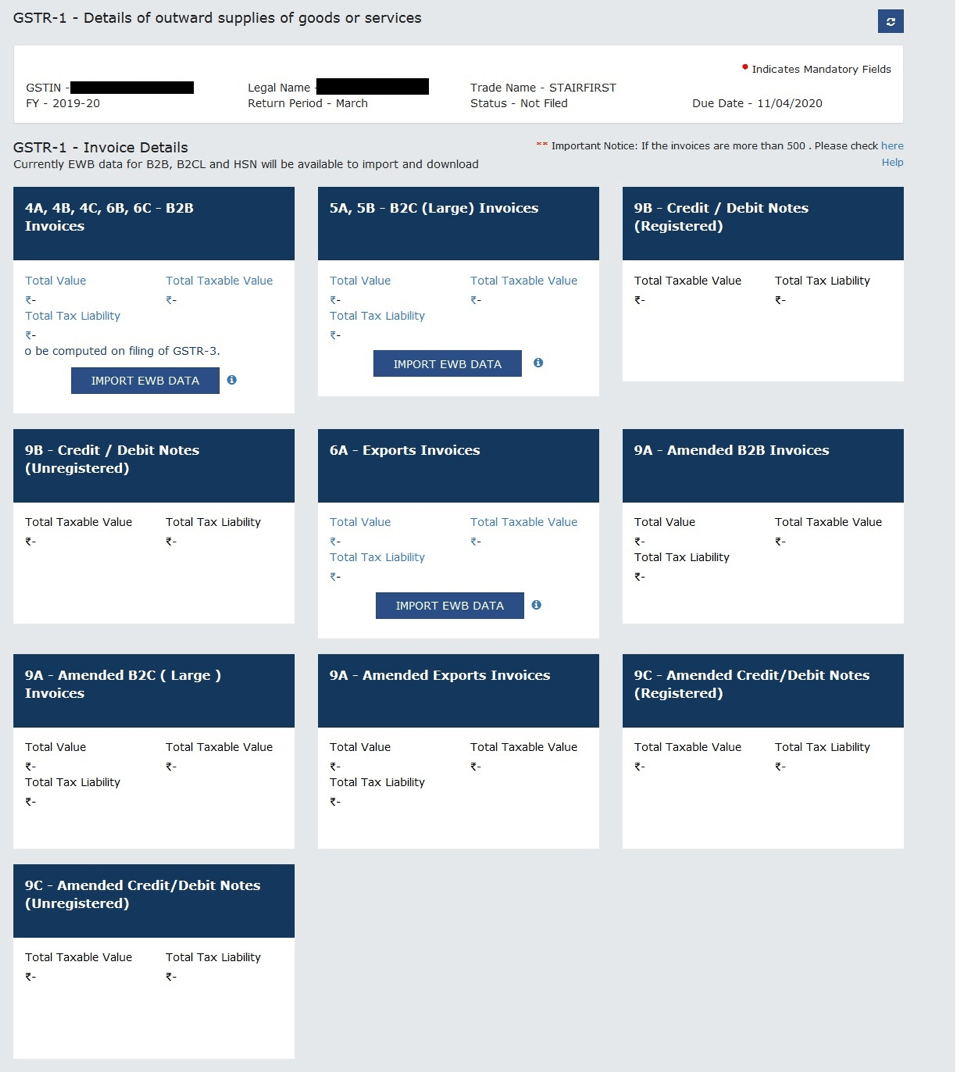

Step 4: Select GSTR-1 in the option and click on “Prepare Online”, the following screen will appear. You need to fill the table of details appearing in the below screen.

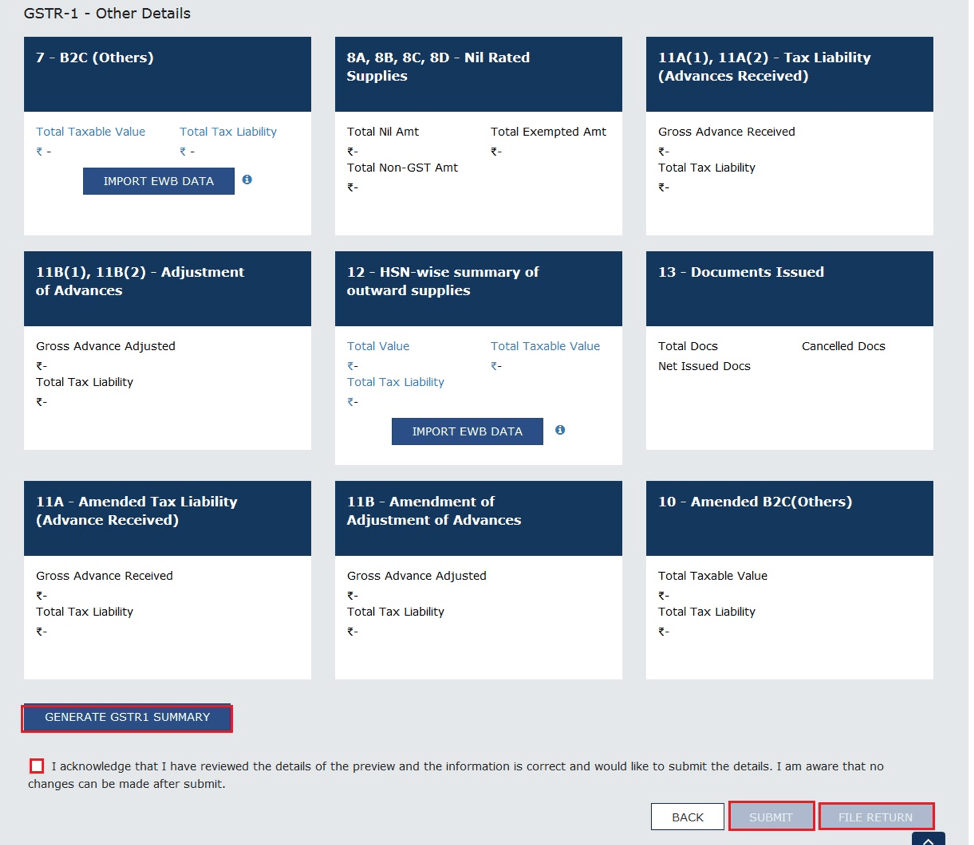

Step 5: After filling the above tables, you need to generate a summary and ensure everything entered is correct. Then you click the ”Submit” button and after that, you cannot make any changes in the application. Then to file the return click on “File Return”.

If you follow the abovementioned simple steps, it guides you through how to file GST returns?

How to file GST return: GSTR- 3B

It is a summary of Inward & Outward Supplies, with details of ITC to be claimed. This GST return is filed every month and payment of taxes is made in this return. If you need to understand how to file GST return 3B, then please follow the step by step procedure:

Step 1: To file GSTR-3B you need to log in to the GST portal and the following screen will appear.

Step 2: Click on “Return Dashboard” on the above screen and the following screen will appear. Select the period for which you must file the return.

Step 3: After you click on the “Search” button in the above image. The following screen will appear. You will see GSTR-3B on the right-hand corner of the screen.

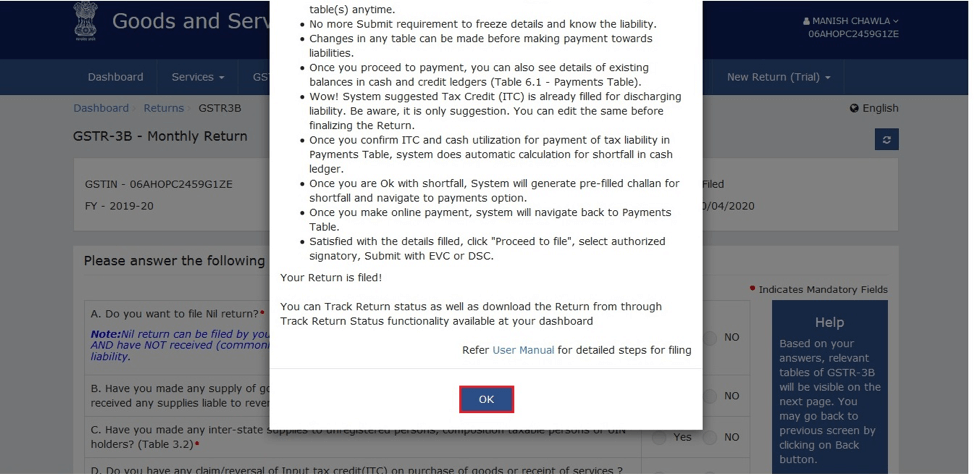

Step 4: Click on the “Prepare Online” button and the following instructions will appear. Read these instructions carefully and then click “OK”.

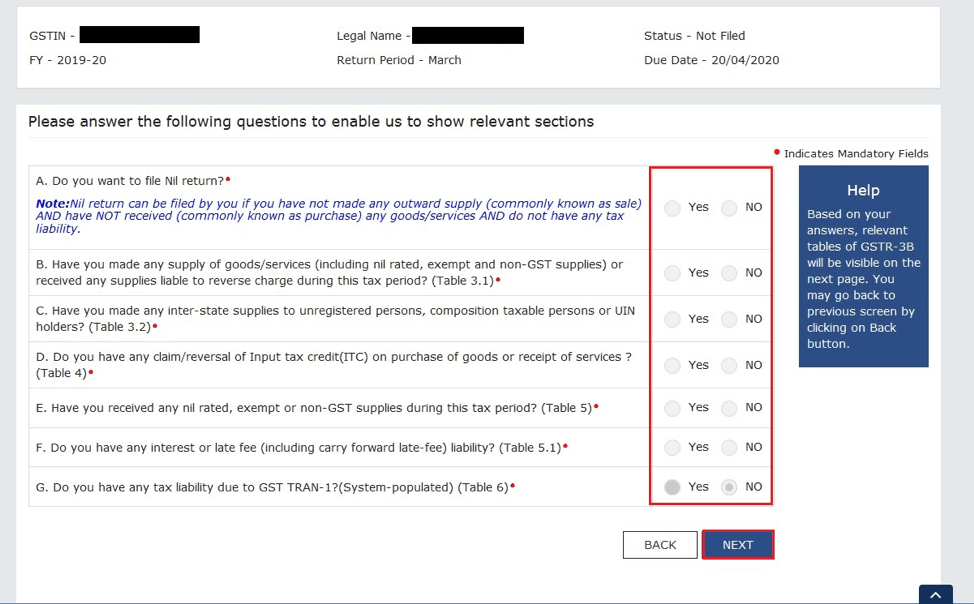

Step 5: After you click “OK”, then select the options relevant to you in the below screen. Then click on the “Next” button.

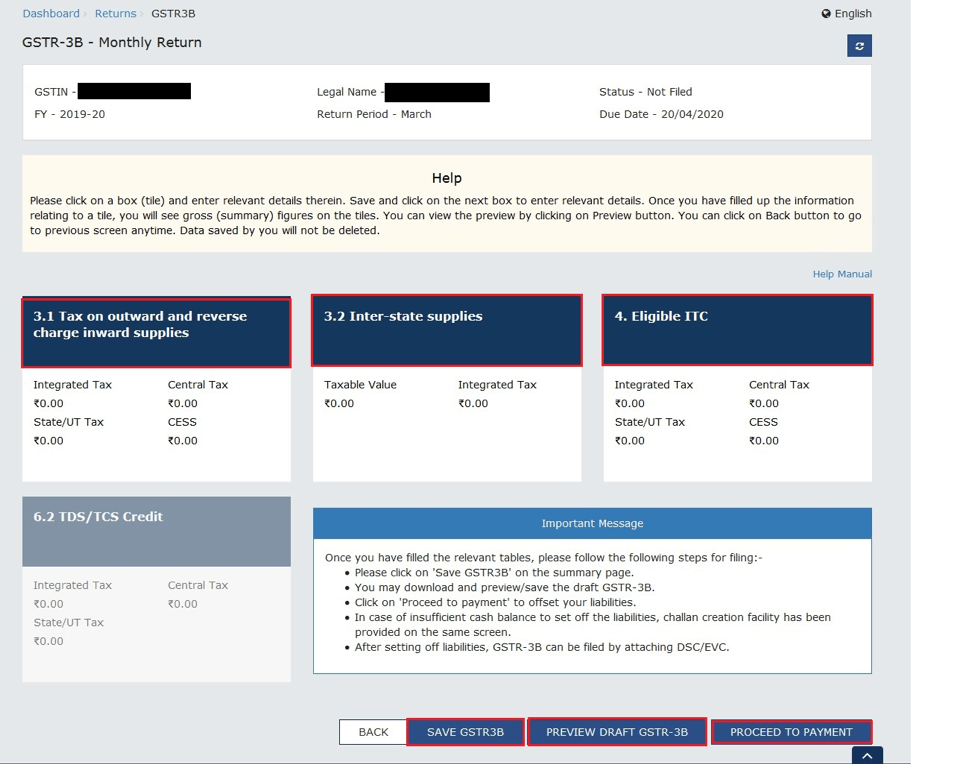

Step 6: The following screen will appear containing a table under which you have to furnish a summary of supplies made and reverse charge supplies in table 3.1

In table 3.2- You will also need to mention the summary of Inter-state supplies made to unregistered persons

In table 4- mention details of Input Tax Credit you want to claim during the period. Remember to enter only valid details of ITC.

Step 7: After you fill the above details you can save your work done by clicking on “Save GSTR-3B” or “Preview Draft GSTR-3B”. When you are ready to make payment and file GSTR-3B click on “Proceed to Payment”. After that following screen will appear.

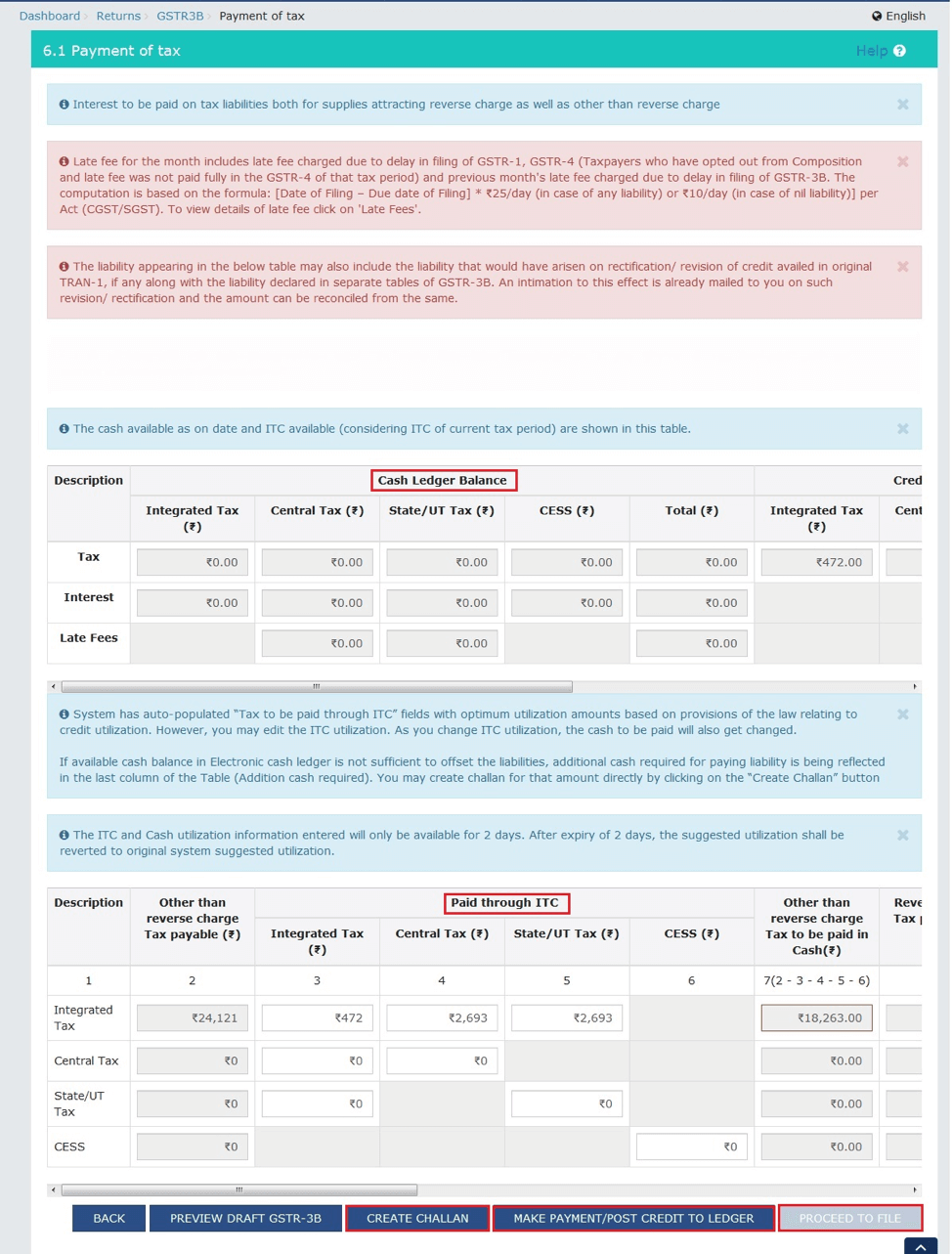

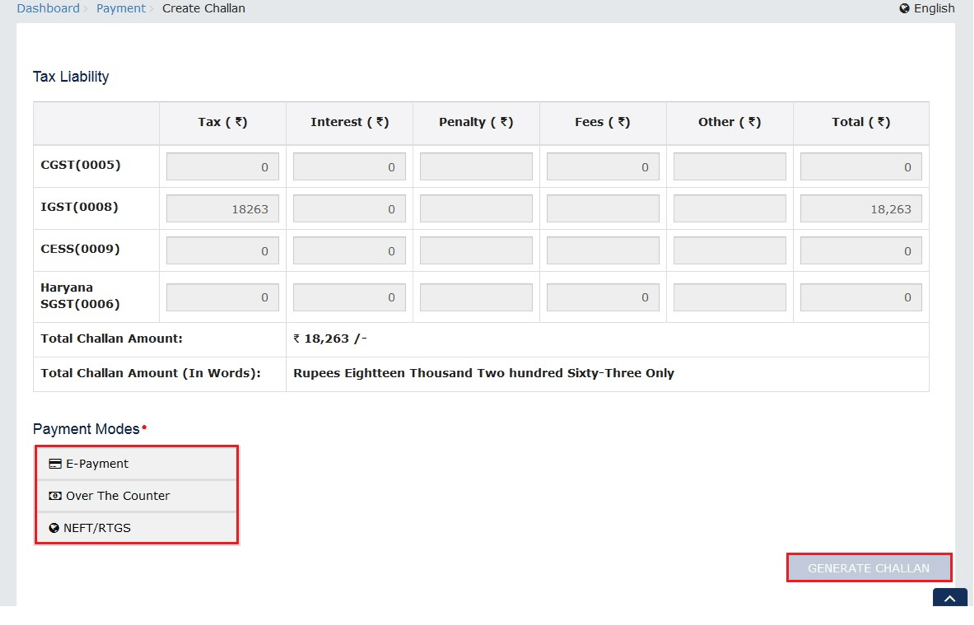

Step 8: You will have to confirm the details of ITC utilized then if any balance is left, click on “Create Challan”. The following screen will appear showing the amount to be paid under SGST/UTGST/IGST/CGST.

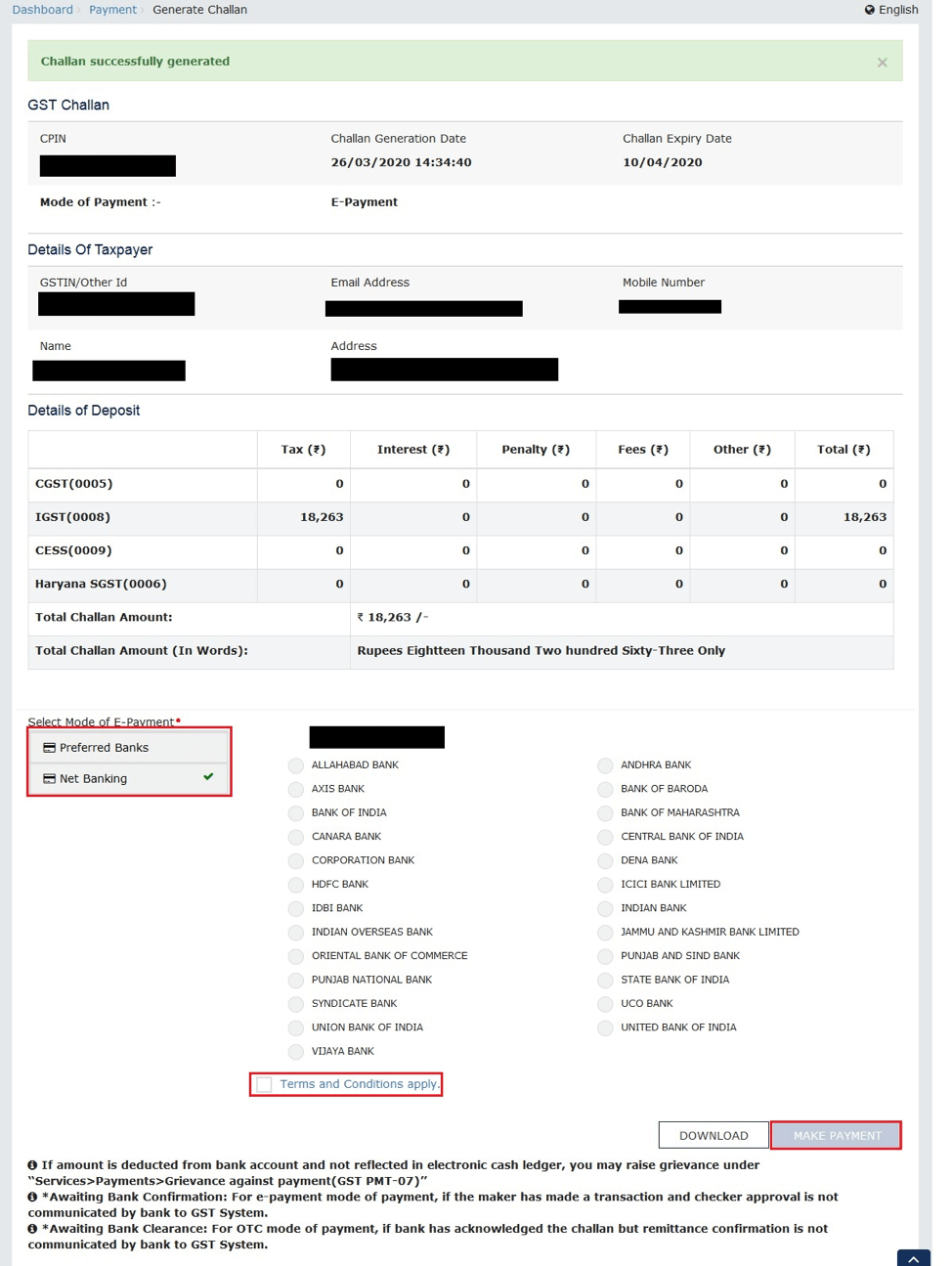

Step 9: In the above screen select your preferred way of payment and click on “Generate Challan”. The following screen will appear.

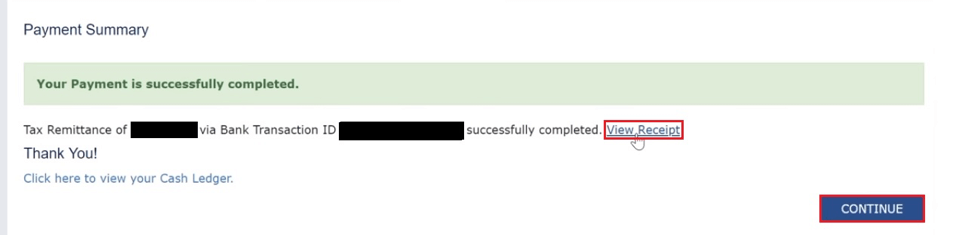

Step 10: Select your preferred way of payment, bank and click on “Make Payment”. A screen will appear showing a summary of payment made. To download the receipt of payment, click on “View Receipt”. To proceed further click on “Continue”.

Step 11: The next screen will be the same as appeared in Step 7, but the additional cash required field will be Zero. Now click on “Make Payment/Post Credit to Ledge”.

Step 12: A warning will be displayed click on “YES”. A dialogue box will appear displaying offset successful, click on “OK”.

Step 13: Now click on the “Proceed to file” button. In the next screen accept declaration and file return through EVC or Digital Signatures. Your return will be successfully filed displaying Acknowledgment reference number.

Once you follow the simple steps mentioned above, it answers all your questions related to how to file GST return online?

FREQUENTLY ASKED QUESTIONS (FAQs)

- Which return should be filed as a final return?

GSTR-10 is a final return, it should be filed within 3 months of the date of cancellation or date of order of cancellation whichever is later.

- Which return is filed by the Unique Identity Number (UIN) holder?

GSTR-11 is filed by persons holding UIN to claim a refund of the GST paid.

- Which return is known as annual return and what is the due date of filing annual return?

GSTR-9/9A/9C are known as annual returns, the due date of filing these returns is 31 December of the next financial year, or as notified by the Government.

- How to file GST returns? Do I have to file GSTR-3B monthly?

Yes, GSTR-3B is to be filed monthly, regardless of the turnover.

- Which return is filed by the Input Service Distributor?

The Input Service Distributor needs to furnish details of Input tax distributed in GSTR-6

- Can Input Tax Credit be used to pay the tax liability?

Yes, input tax credit accrued on purchase made during the normal course of business, can be used to set off tax liability.

- Do I need to file GSTR-3B even if my Input Tax Credit is greater than my tax liability?

Yes, every person must file GSTR-3B, in case of non-filing of GSTR-3B the penalty and interest on late filing may be levied.

- I am a dealer registered under the composition scheme, which returns should I file?

A dealer registered under the composition scheme must file GSTR-4 by the 18th of the month following the end of the quarter.

- Which details are required to be submitted in GSTR-1 and how to file GST return?

All taxpayers must furnish details of all outward supplies made during the period including the purchases on which reverse charge is paid. Also details of all credit notes, debit notes and revised invoices must be furnished. It can be filed online using the portal www.gst.gov.in

- What details are contained in my GSTR-2A?

Form GSTR-2A contains details of all purchases made by you from registered suppliers. Input Tax Credit available to you for the taxpayer is reflected in this form.

StairFirst is an e-service platform which provides company registration, corporate compliances, GST, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details