In India, every person who is having a taxable income is mandatorily required to hold PAN (Permanent Account Number). In this article, we will tell you what to do when the PAN card is lost and how to get a duplicate PAN card in India.

The Income Tax Department issues PAN Card to the taxpayers. It is also important for doing certain financial transactions, as you cannot proceed until the submission or disclosure of PAN. There might be a situation when you suddenly realise that your PAN card is lost or damaged.

Procedure to get duplicate PAN Card in India

Similar to downloading your e-PAN, when your PAN card is lost or destroyed you can apply for duplicate PAN card. The process to get the PAN card is online and also offline to facilitate end-users.

ONLINE PROCEDURE FOR DUPLICATE PAN CARD

In case you have lost your PAN Card or have misplaced it or it has been stolen, you needn’t worry. Simply, follow the steps mentioned below for getting the duplicate PAN card in India:

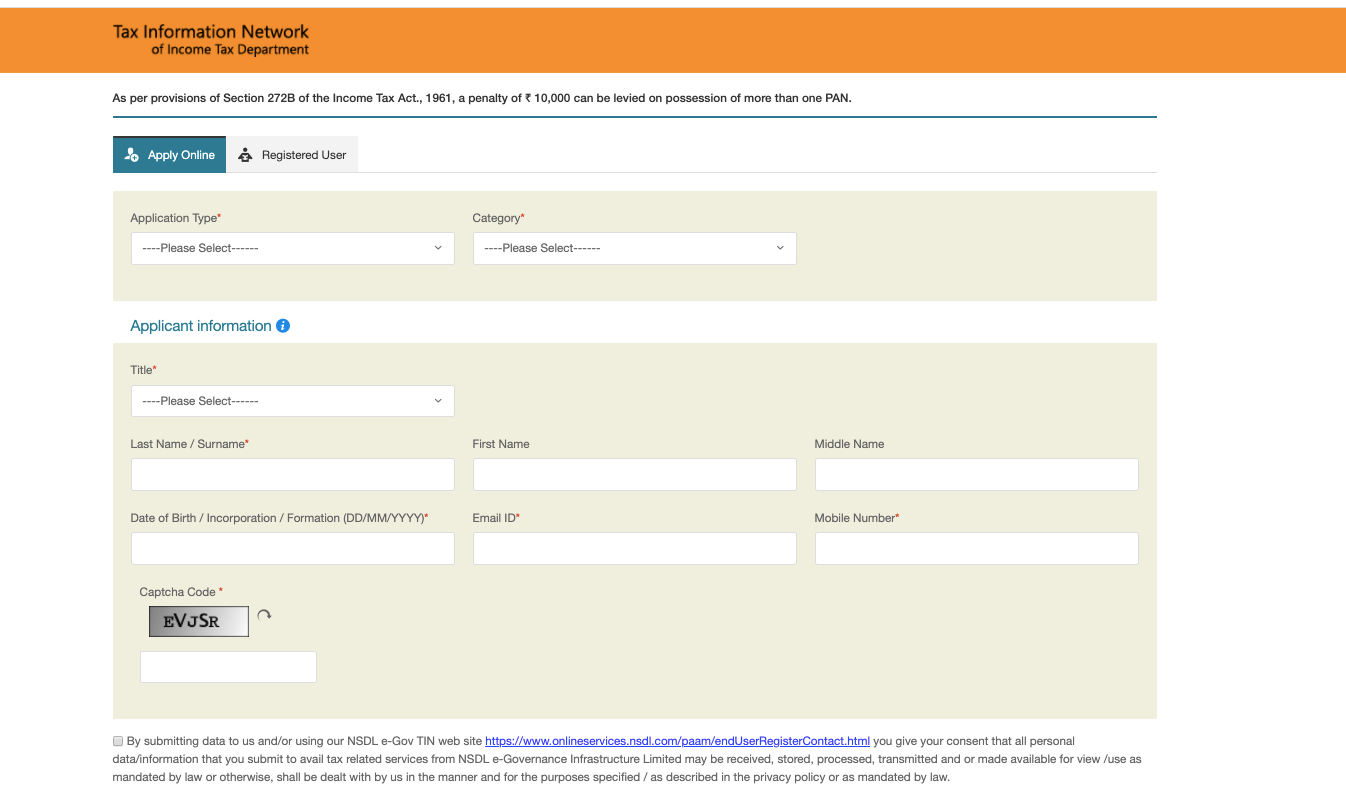

Step -1: Visit the website of the NSDL by Clicking Here. The above screen will appear on the window.

Step – 2: Now, in the above screen choose “Apply Online” if you are making a fresh application and the “Registered User” option can be chosen by those who have already started an application but could not complete it yet. We are considering a fresh application in this article.

Step – 3: For the “Application Type” field, choose “Changes or Correction in existing PAN Data/Reprint of PAN Card (No changes in existing Pan Data)” option from the drop-down list and for the “Category” filed choose the respective category as per the Lost PAN Cardholders’ status i.e. Individual/Company/Limited Liability Partnership/Trust, etc. from the drop-down list.

Step – 4: Now, furnish the required details in the respective field and enter the captcha in respective filed and then click on the “Submit” button.

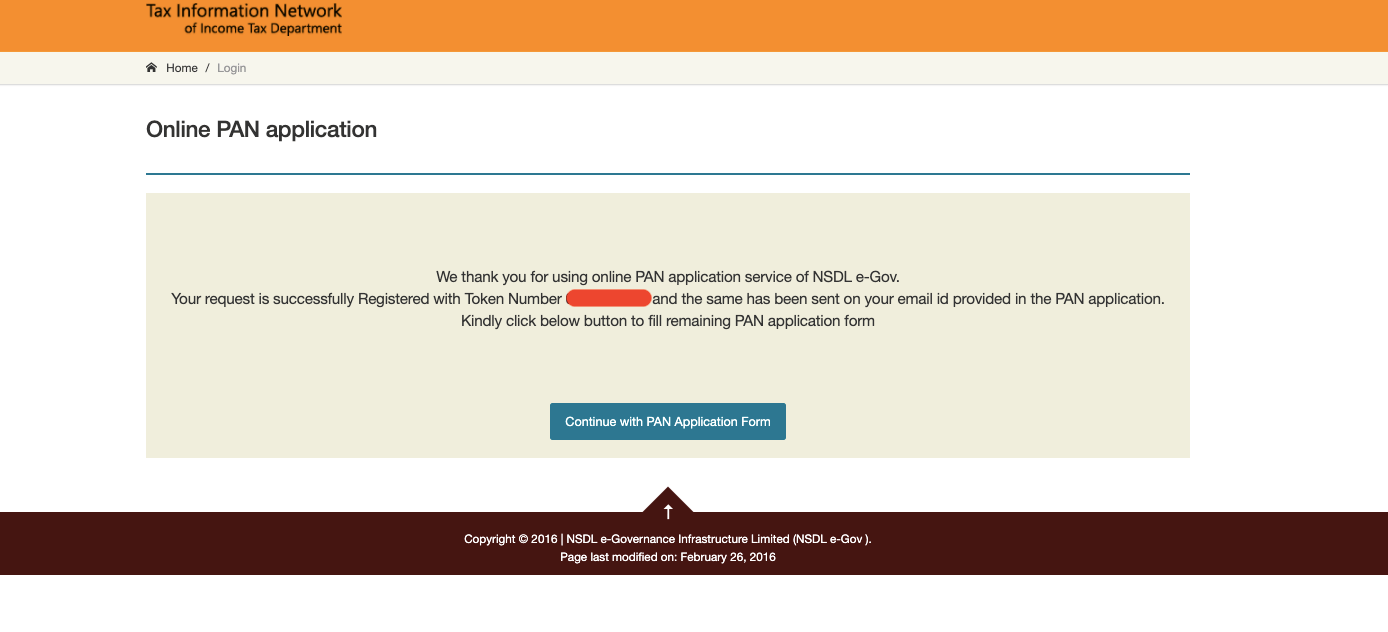

Step – 5: As you click on the submit button, the following message will appear on your screen containing the Token Number for your application, which can be used for future reference and the same will also be sent to you on the E-mail ID provided by you. This ends the basic phase of duplicate PAN card in India and takes you to the next phase wherein details need to be provided.

Step – 6: Now, click on the “Continue with PAN Application Form” button.

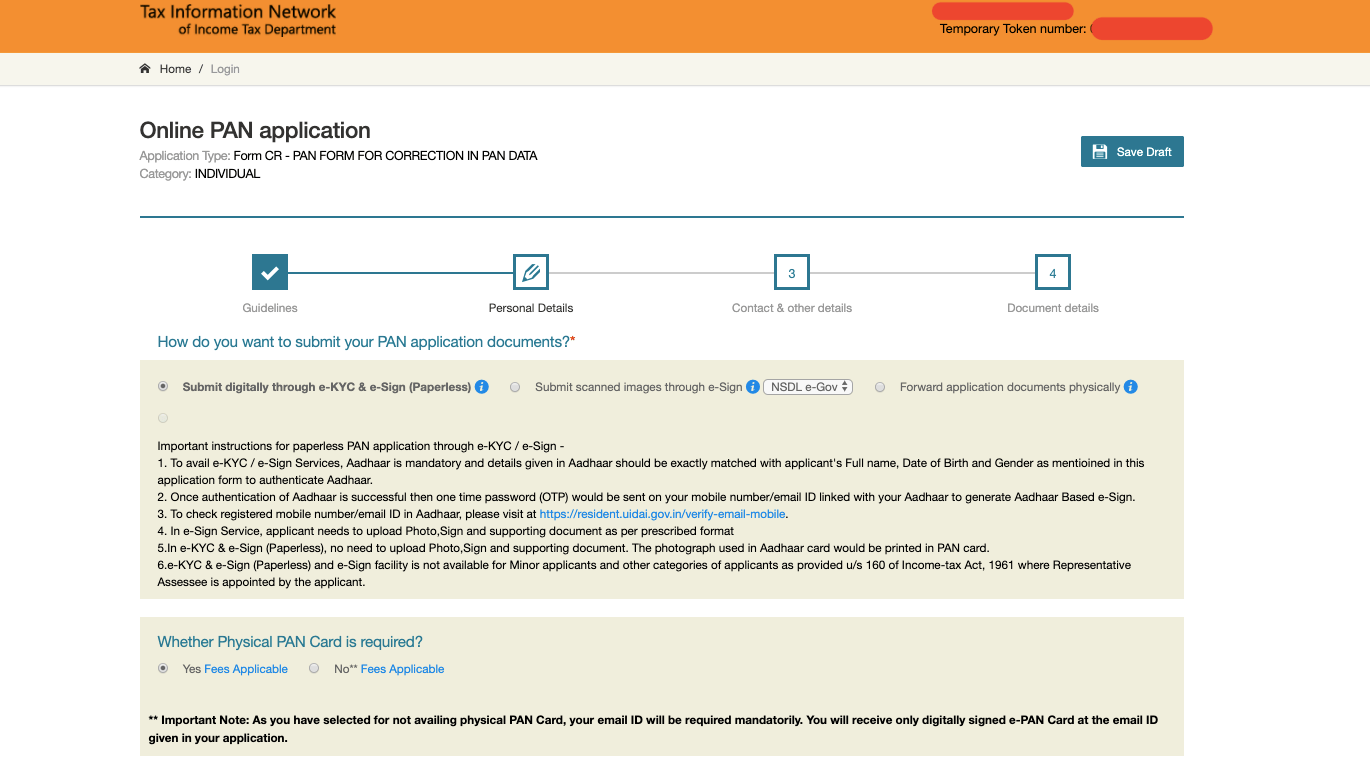

Step – 7: Thereafter, select the mode of PAN application from the given options as shown in the image below and fill in the required details:

Step – 8: While choosing the option, please follow “Important Instructions” for duplicate PAN card in India. It shall be noted that for availing “e-KYC/e-Sign” services “Aadhar” is mandatory and these options are available to “Major Individual Applicants (equal to or more than 18 Years of Age)” only.

Step – 9: Now, fill in the required details in respective fields and click on the “Next” button.

Step – 10: In this step, fill the contact and other details as required and again click on the “Next” button.

Step – 11: Here, choose the Supporting documents from the drop-down list to be uploaded as Proof of Identity, Proof of Address, Proof of Date of Birth and Proof of PAN. In case, if you are not having any Proof of PAN such as “Copy of PAN/PAN Allotment Letter” then select “No Document” from the drop-down list.

It shall be noted that if no document is uploaded as Proof of PAN then the application is processed by the Department on the ‘Good Effort’ basis. It means that the application will be processed by the Department only if all the details of the applicant as furnished in the application are matching with the PAN database of the Income Tax Department.

Step – 12: After furnishing all the required details and uploading required documents, click on the “Submit” button.

Step – 13: Now, you will be directed to the Payment page through which the fee is to be deposited. Pay the requisite fee as applicable for issuance of duplicate PAN card in India.

Step – 14: On the payment of fee successfully, the application will be submitted to the department and an acknowledgement receipt will be generated consisting of the ‘Acknowledgement Number’ which can be used for tracking the application status and future reference.

Step – 15: If you have chosen to “Forward Application Documents Physically” in Step – 7 above, then you have to send the application along with uploaded documents and acknowledgement receipt to the NSDL e-Gov at “Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016”.

It shall be noted that the application should reach to the NSDL e-Gov within 15 days from the date of application.

The PAN Card will be issued within 14 days from the date of application received by the Department. It shall be noted that to make an application for Duplicate PAN Card in India you must know your PAN Number. If do not know your PAN or have forgotten your PAN Number, then you should contact the NSDL Customer Care in this regard.

Offline Procedure for Duplicate PAN Card:

The application for Duplicate PAN Card in India can be made through offline mode as well by following the steps given below:

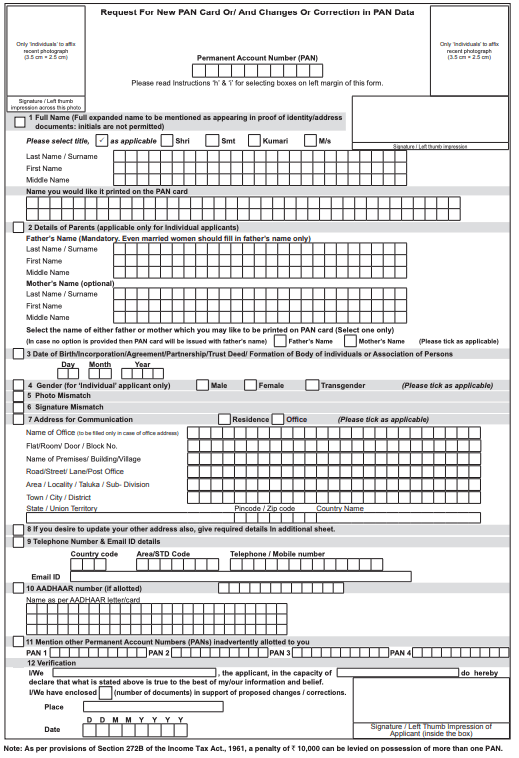

Step – 1: Visit the nearest NSDL PAN Facilitation Centre for obtaining the “Request For New PAN Card Or/ And Changes Or Correction in PAN Data” Form as shown in the image below:

Step – 2: Fill the required details in Block Letters and use Black ink to fill-up the form. The form should be filled in English Language only.

Step – 3: In case of Individual Applicant only, affix 2 Passport Size photographs in the respective columns given in the form and sign them across (remember that sign does not cover the face of the applicant on the photograph).

Step – 4: Now, Sign under the given columns of Form and submit the requisite fee of Rs. 110/- for receiving PAN at Indian address or Rs. 1,020/- for receiving PAN at foreign address, as the case may be.

Step – 5: Now, on payment of fee, an Acknowledgement Receipt will be generated.

Step – 6: Thereafter, send the Application Form along with Acknowledgement Receipt, Proof of Identity, Proof of Address and Proof of PAN to NSDL PAN Facilitation Centre. Copy of FIR lodged (if any) for loss of PAN Card may also be attached to the application.

The PAN Card will be issued within 14 days from the date of application received by the Department.

To conclude, by following the simple steps mentioned above you can get a duplicate PAN card in India. It is pertinent to note that it is provided at a very nominal fee.

FAQs:

1. I have lost my PAN Card, what should I do first?

You should first lodge an FIR with Police so that your PAN Card could not be used for illegal and unauthorised purposes.

2. In which situations Duplicate PAN card in India is issued?

Duplicate PAN Card is issued in the case of Lost/Theft/Misplaced/Deterioration

3. Can I make an application for New PAN while holding one?

No, holding more than one PAN is illegal as per the provisions of the Income Tax Act, 1961.

4. Is it necessary to lodge FIR on the lost/theft of PAN Card?

No, it is not mandatory to lodge FIR on the lost/theft of PAN Card. However, it is most recommended to do the same to protect your PAN from illegal use.

5. How to Find the Owner of a lost PAN Card?

If you have found someone’s lost PAN Card, the first thing you can do is to submit the same with Police. You may also submit the same to the nearest TIN Facilitation Centre.

6. Do I need to pay any fee for Duplicate PAN Card?

Yes, you need to pay the requisite fee as per the “Mode of Application” chosen by you at the time applying for Duplicate PAN Card.

7. In how many days should I receive Duplicate PAN Card?

You will receive the Duplicate PAN Card within 14 days from the date of receipt of Application by the Department if no discrepancies were found in your application.

8. Is it necessary to know PAN Number while making an application for Duplicate PAN Card?

Yes, it is mandatorily required to know PAN Number for making an application for Duplicate PAN. If you don’t know or have forgotten your PAN Number, you can make a call to the NSDL Customer Care for assistance in this regard.

StairFirst is an e-service platform which provides company registration, corporate compliances, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details