You might come across a situation when GST number has been taken and you no longer need it. There might be multiple reasons for GST cancellation. In addition, there might be an event due to which the Government has decided to cancel your GST number. In this article, we will discuss the GST Registration cancellation process step by step.

As per Sec 29 (1) of the Act, the GST registration can be cancelled by the officer either on his own or on receiving the application of cancellation from the registered person or his legal heirs in case of death.

The registration can be cancelled in cases where:

1. The business has been discontinued or transferred. The cause of any of this may be due to:

- the demise of a person carrying on the business, or

- if the business was merged with another business i.e. amalgamation; or

- if the existing business was divided into two or more parts i.e. demerger; or

- shutting off business operations.

2. The constitution of the business has changed (For example- Sole Proprietorship has been converted to Private limited company).

3. If a person is not required to be registered under the following sections:

- Sec 22- not crossing threshold limit for mandatory registration under the GST

- Sec 24- This section includes person supplying interstate supplies, casual taxable persons, person pay GST under reverse charge mechanism, electronic tax operators and other persons mentioned.

We will guide you through the reasons for GST cancellation and GST Registration cancellation process under each scenario in this article.

REASON FOR GST CANCELLATION BY THE DEPARTMENT

The department may cancel the GST registration on the following grounds:

1. On breach of any law or provision of the GST Act

2. Non-filing of GST returns also leads to cancellation of the GST registration on own volition of the department. The registration can be cancelled in two scenarios:

- Under composition scheme- non-filing of return goes on for three continuous due dates.

- Others (not included above)- non-filing of return continues for six months continuously

3. Non-commencement of business: If any person or business opts for registration under GST of his own volition i.e. voluntary. Such a person or business does not start operations in 6 months from the date of registration.

4. If it is found that the registration is obtained through frauds or by willfully misstating or suppression of facts.

GST REGISTRATION CANCELLATION PROCESS BY THE DEPARTMENT

As discussed above, the department may cancel the registration of a person on its motion. The procedure of the same are as follows:

1. The show-cause notice will be issued by the Proper Officer to the person in Form GST Reg-17. It is to ask why registration of a person must not be cancelled?

2. The reply must be submitted in Form GST Reg-18, within 7 days of receipt of such notice.

3. If the officer is satisfied, then he may pass the order and the person must reply within 7 days of receipt of such notice.

OR

If the officer is not satisfied with the reply, he may issue an order in Form GST Reg-19 within 30 days of receipt of such reply. Such order shall consist of the date of cancellation and liabilities of the person to be paid.

GST Number Cancellation Process by Registered Person (Voluntary)

A person can also apply for voluntary cancellation of GST Registration. He must file an application in the Form GST Reg-16 on www.gst.gov.in. The officer if satisfied may accept the application and grant cancellation of registration.

Following are the steps for GST Registration Cancellation process that Registered person has to follow:

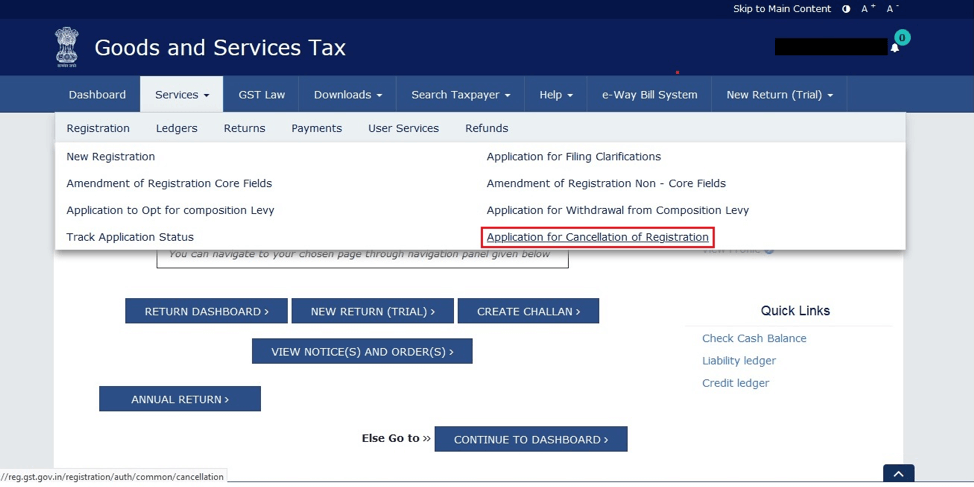

Step 1: Log in to GST portal www.gst.gov.in.Go to button “Application for Cancellation of Registration” under user services in Services tab.

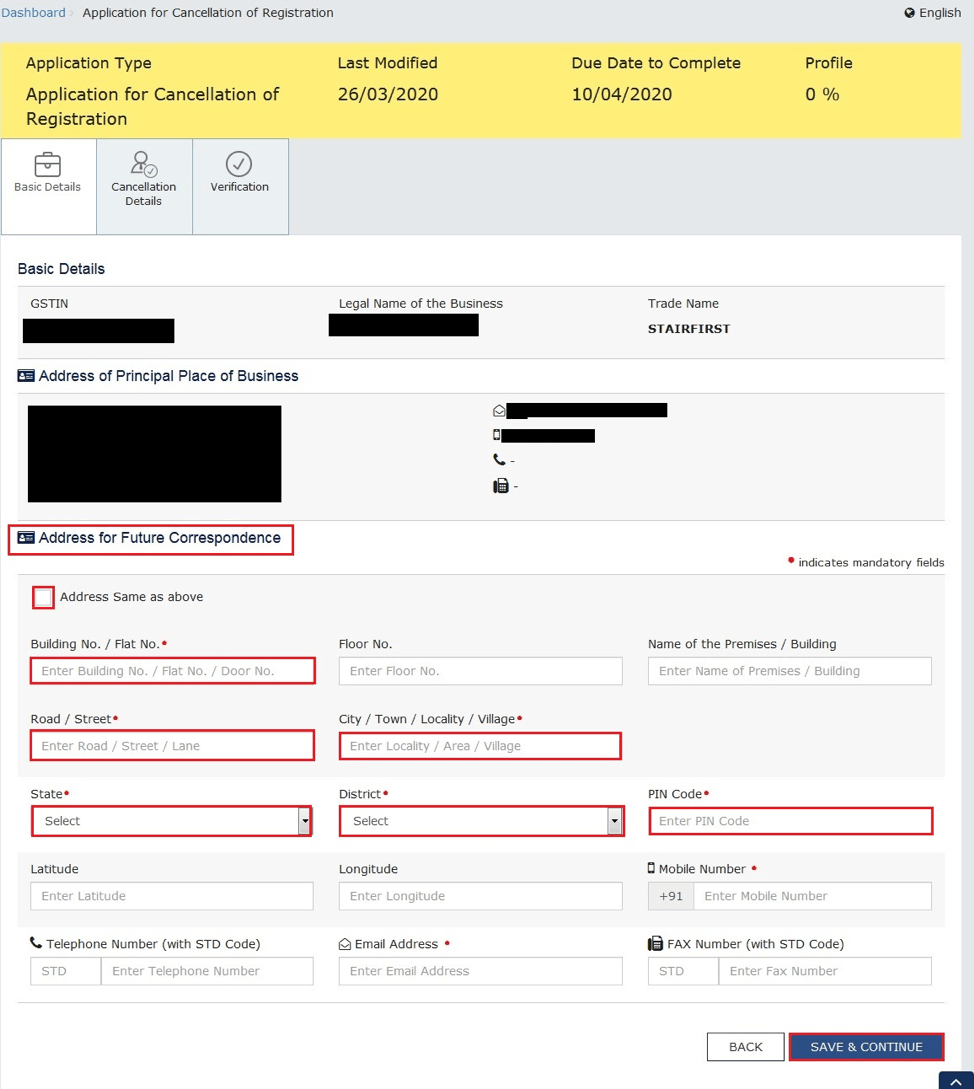

Step 2: The following screen will appear, showing basic details of your business. You will have to provide the address for future communication with the department.

Step 3: Tick mark button “address same as above” if your address is the same as above.

Step 4: After entering the above details, click on “Save & Continue”. The following screen will appear.

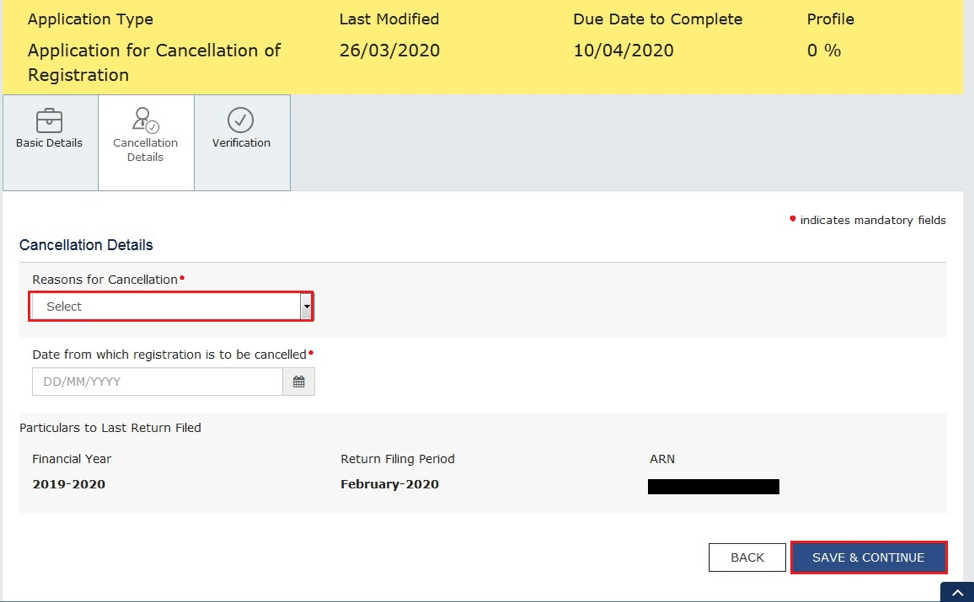

Step 5: Enter the reason for the cancellation of your GST registration in the drop-down menu. The reasons shall be as follows:

- Change in constitution of business leading to change in PAN. Example, change in nature of business such as the conversion of sole proprietorship into a private limited company.

- Ceased to be liable to pay tax- if the person is not liable to pay taxes due to change in law or business activity

- Discontinuance of business/ Closure of business- if a person shuts off business operations

- Others

- “Transfer of business on account of amalgamation, merger, demerger, sale, leased or otherwise”- if the business has changed structurally by merging into another business or demerging into two or more businesses or sale or any other reason.

- Death of sole proprietor- in case of demise of the proprietor.

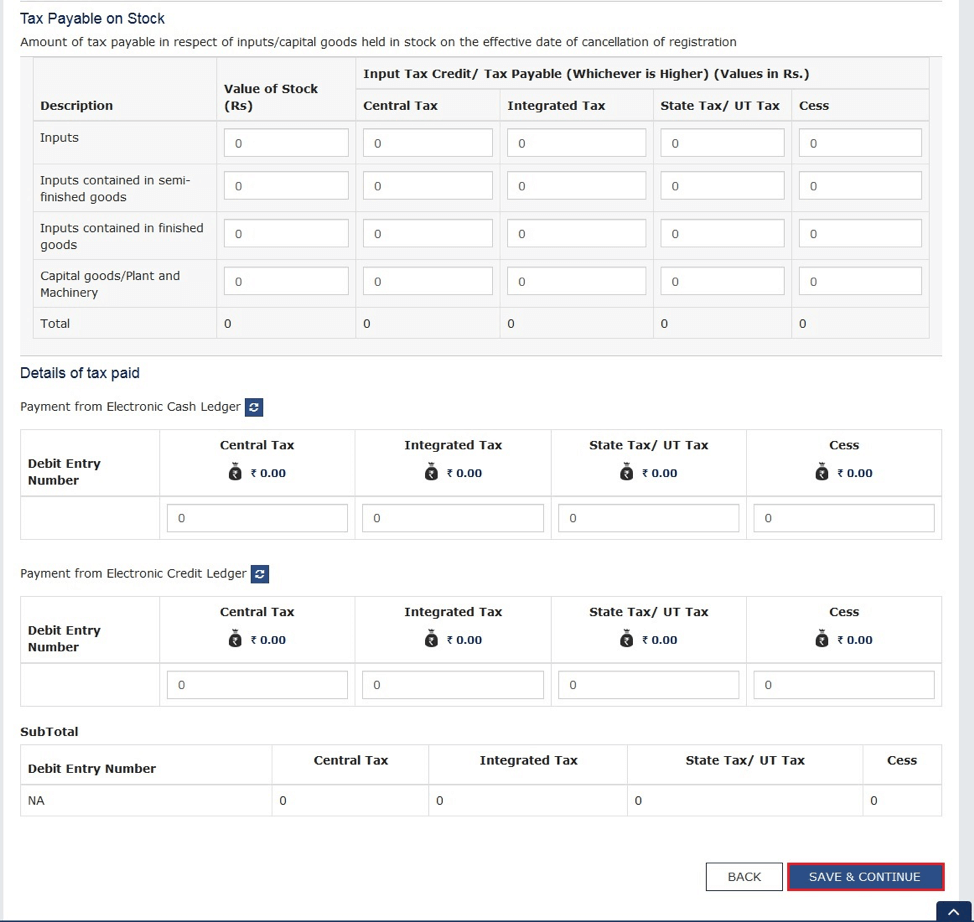

Step 6: After that, enter details of tax payable in the continuing form and then click on “Save & Continue”.

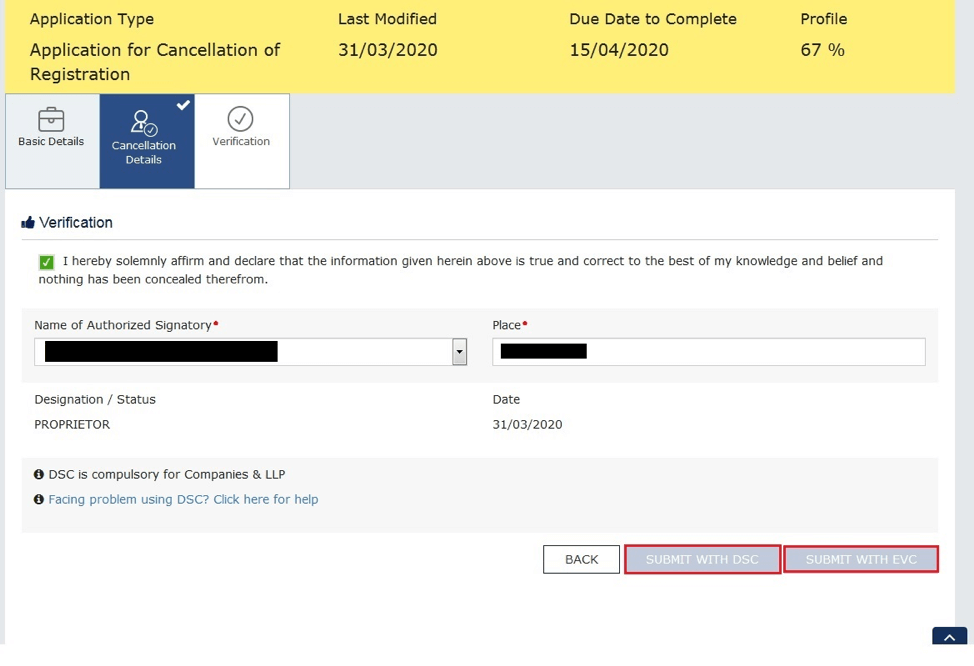

Step 7: In below screen, the verification process will take place, after you fill the place and verify details. The option of “Submit with DSC” and “Submit with EVC” will appear to select your preferred option and submit the application.

Step 8: After that, you will receive an acknowledgement number on your registered email id and mobile number. You can also track the status of your application on the portal in track application status.

After submitting your application, a Proper Officer will examine details of your application and if satisfied will pass an order for cancellation of Registration in Form. This completes the GST number cancellation process.

FINAL RETURN

As per Section 45 read with rule 81 of the CGST Rules, every person whose registration is surrendered or cancelled is required to file GSTR-10 on the GST portal. GSTR-10 is known as Final Return.

The time limit for filing GSTR-10 is later of the following date:

- within 3 months of the date of cancellation; or

- date of order of cancellation.

REVOCATION OF CANCELLATION OF REGISTRATION (SECTION 30)

If cancelled by the department on its motion:

The person whose registration has been cancelled must apply for revocation of cancellation of registration in Form GST Reg-21. It has to be done to the Proper Officer within thirty days from the date of the service of the order of cancellation of registration. It can be done online at the www.gst.gov.in or through a Facilitation Centre.

If cancelled on failure to furnish returns

The person firstly must furnish all such returns and pay any tax outstanding including interest, penalty or late fee. Then after that, this application for revocation of cancellation of the GST registration should be made in Form GST Reg-21.

Procedure for Revocation of Cancellation of GST Registration

Step 1: An application must be made, in Form GST Reg-21, by the person whose registration has been cancelled.

Step 2: Within 30 days of receipt of the application the Proper Officer, if satisfied and believe there are enough grounds for revocation. Then the officer shall pass an order in GST Reg-22 for revocation of cancellation of registration

OR

If on examination of an application the Proper Officer is not satisfied, will issue Show Cause Notice in GST Reg- 23, enquiring why should the application for revocation not be rejected. Within 7 days of receipt of such notice, the reply must be given in Form GST Reg-24.

Step 3: On receipt of application in Form GST Reg-24, the officer shall examine the application. Within 30 days of receipt of such application, and on being satisfied may issue the revocation of cancellation of registration in Form GST Reg-22.

However, if the officer is not satisfied, the opportunity of being heard will be provided to the applicant. After failing to give ample reasons to officer to not to accept the application. The officer will record his reasons in writing. The order shall be an order of rejection of application of revocation of cancellation of GST registration in Form GST Reg-05.

To conclude, we have to remember that GST registration cancellation process is an easy process, but attention has to be given to all compliances prescribed by law. If we fail to adhere to conditions, it might not only delay the process but result in fines and penalties.

FREQUENTLY ASKED QUESTIONS (FAQs)

1. I am a dealer registered under GST but have not crossed the threshold limit. What is the GST registration cancellation process?

You can apply for cancellation of GST registration on the GST portal www.gst.gov.in

2. If I do not file a return for 6 months can department cancel my GST registration?

Yes, in case of non-furnishing of the return for a continuous period of 6 months the department on its own volition may cancel your registration.

3. Do I have to file any return after the filing of application of cancellation of registration?

Filing application of cancellation of registration does not absolve a person from his liability to pay tax, hence a person must file his returns regularly.

4. What is the final return? When do I have to file the final return?

GSTR-10 is known as the Final Return. The time limit for filing GSTR-10 is later of the following date:

- within 3 months of the date of cancellation; or

- date of order of cancellation.

5. I am a registered dealer; my GST registration was cancelled by the department. Is there any way I can obtain my previous GSTIN and cancel that order of the department?

Yes, you can have the same GSTIN. However, to obtain the same GSTIN you must apply for revocation of cancellation of GST registration within 30 days of receiving the order of cancellation. It must be noted that, if your registration is cancelled for non-filing and non-payment of tax then you must first furnish your returns and pay off your tax liabilities. Only then you must file an application for revocation.

StairFirst is an e-service platform which provides company registration, corporate compliances, GST, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details