TRACES is an abbreviation used for TDS Reconciliation Analysis and Correction Enabling System. It is a website of the Income Tax Department setup for compliances related to TDS. All users who are responsible for the collection and deduction of tax are supposed to use TRACES. It is also used to complete compliances related to Tax Collected at Source (TCS). In this article, we will discuss what is TRACES, its features and what is form 26AS from TRACES?

The income tax department has started the online TDS portal TRACES, to facilitate the easy filing of TDS returns. A tax deductor needs to register on the portal firsthand. The traces portal helps in filing return, filing of correction statement, issue of tax certificates.

The setting up of the online portal for TDS has provided great respite to the users. Earlier, people had to use the facilitation centres, the whole process was cumbersome and tiring. The TRACES portal has eliminated the need for users to go to the facilitation centres. Now, the filing of replies and requests for issuing of form is made online. You can also file the correction of return online.

The TDS Traces website is primarily used to view and download key tax documents such as Form 16, Form 16A and Form 26AS.

What is Form 26AS from TRACES?

Form 26AS contains details of all tax deducted or collected by a taxpayer during the year. It is available for view on TRACES portal. It reflects the credit of payment of TDS done against the PAN Card of the user. If you want to understand what is Form 26AS from TRACES, then it can be very well understood by the components:

- Tax deducted by deductors

- Tax collected by collectors

- Payments for Advance tax

- Refunds received in a financial year

- Self-assessment tax

- Regular assessment tax

Important Features of TRACES

We will discuss some salient features of TRACES first and then later we would discuss in detail what is Form 26AS from TRACES and step by step guide to download it. Some of the important features of the TRACES website are as follows:

- View challan status

Correction of TDS Statement

Correction of TDS Statement- Correction of TCS Statement

- Downloading of Form 26AS

- View status of tax statements filed

- Raising the refund request

- Downloading

- consolidated file,

- Justification Report

- You can also raise a request for:

- Form 16

- Form 16A

- Correction of OLTAS Challan

These services provided by the TRACES website have brought about smoothness and efficiency in tax compliance. To compare, earlier people used to file a paper return, which was a time-consuming and ineffective affair. Now, the whole process is available on the TRACES Online Portal, which has streamlined the whole process.

One of the main reliefs provided by this facility is making online corrections. As it is very common that there are mistakes in PAN, Challan, or return at the time of filing. Therefore, now users can rectify the mistakes online and in less time.

Mandatory Filing of Return for a Class of Person

A deductor of tax must file the return regularly. The person who is liable to deduct tax at source on making a specified payment as per the Act is known as deductor. It is the duty of every person deducting tax to deposit the same with the Government. On failure to pay taxes on time attracts interest and penalties. Such, person deducting TDS needs to file their return timely. Do you know you can view the details of all tax deposited or collected? As a taxpayer or deductor, you should always know what is Form 26AS from TRACES? The person is required to file their TDS return online are as follows:

- Companies

- Those liable to tax audit u/s 44AB of the Act

- Government Departments

- Any deductor which has more than 20 deductees for any quarter during the financial year

What is facilities available to a Deductor in form 26AS from TRACES

Some facilities are provided by the Income Tax Department to the deductor when such person registers for TRACES. Those facilities are as follows:

- Creating an Admin user and sub-user

- Viewing of challan status.

- Download

- Justification Report

- Form 16

- Form 16A

- View the following

- TDS – TCS credit for a PAN.

- View PAN Master for the TAN.

- View Statement Status.

- Validate 197 Certificates

- Online Correction of:

- PAN

- Challan

- Returns

- Filing Declaration for Non – filing of Statement.

- TDS Refund.

- Offline Correction.

What is form 26AS from TRACES and downloading it for Tax Payers

If you are a taxpayer and want to know the status of your tax deducted at source. Then, you can register yourself on TRACES as taxpayers and see the details of tax deducted. For this, you need to understand what is Form 26AS from TRACES and thereby download 26AS and a tax credit statement.

Form 26AS contains details of all tax deducted or collected by a taxpayer during the year. It is available on the TRACES. It reflects the credit of payment of TDS done against the PAN Card of the user.

Login to TRACES Portal

Once you know what is Form 26AS from TRACES, you now need to be registered on the portal. It must be noted that to be able to access TRACES, a person must have a valid TAN.

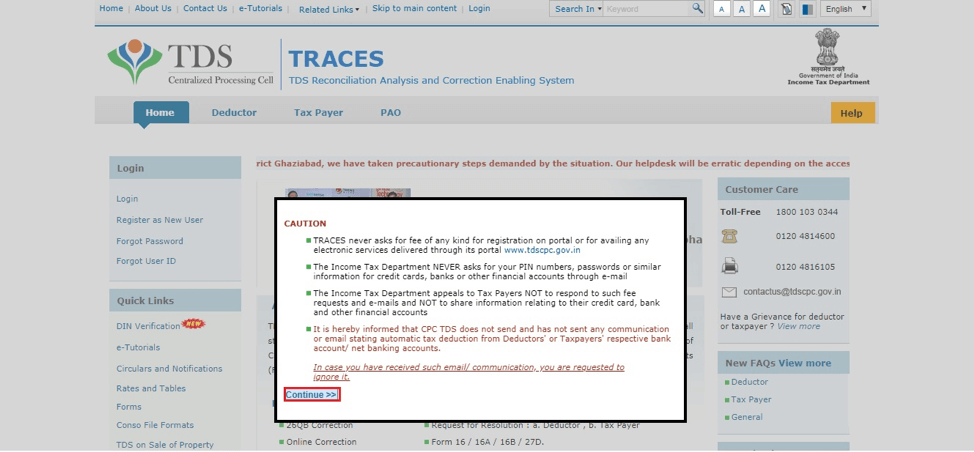

Step 1: Go to https://contents.tdscpc.gov.in/en/home.html. A Caution notification will be displayed as in the below image.

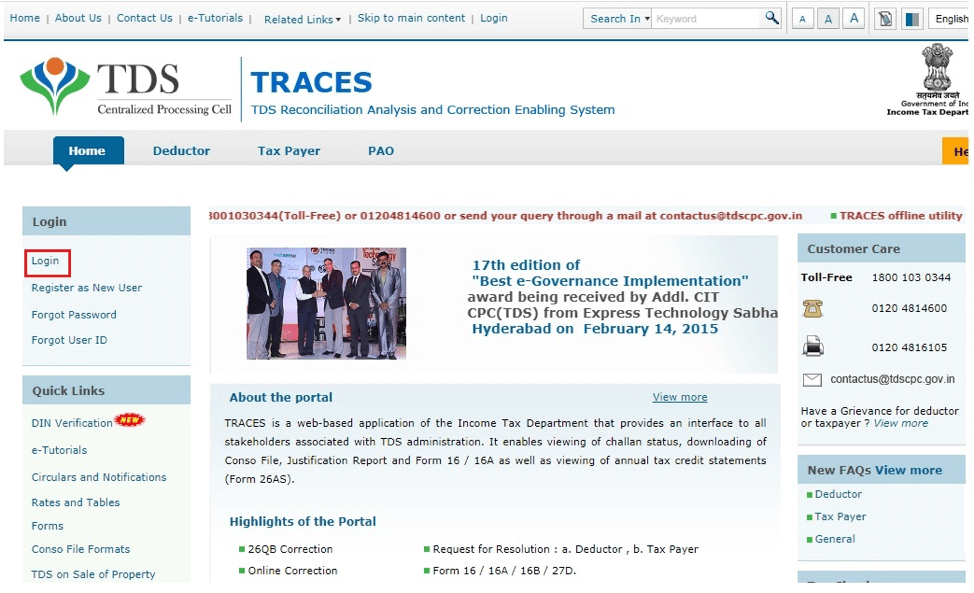

Step 2: Click on the “Continue” button. Then the following homepage will appear.

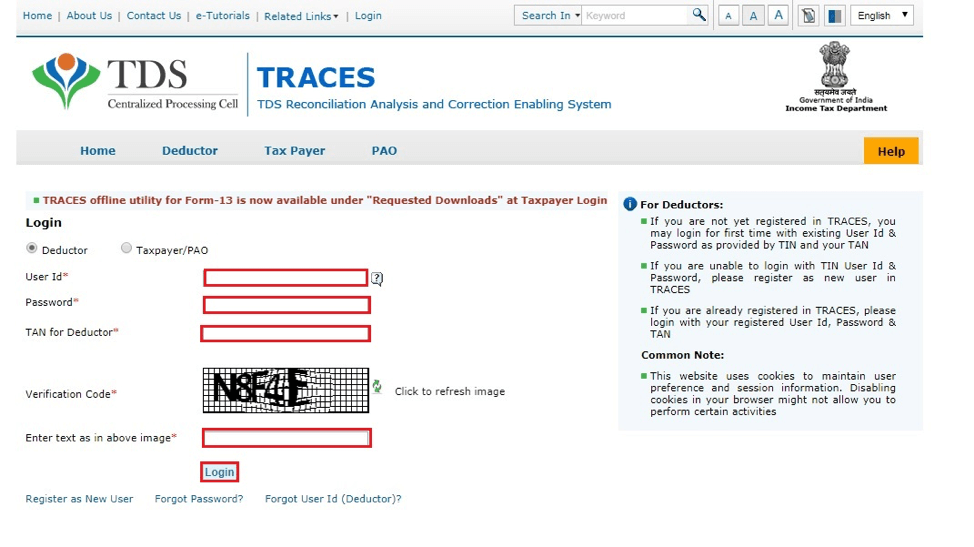

Step 3: Click on the Login button in the above image. The following screen will appear

Step 4: Fill all the details asked in the above page. Then, click on the “Login” button. After that you will be redirected to your Dashboard.

Step 4: Fill all the details asked in the above page. Then, click on the “Login” button. After that you will be redirected to your Dashboard.

FREQUENTLY ASKED QUESTIONS (FAQs)

1. What is TRACES?

TRACES is a TDS portal of the income tax department which is used for filing compliances related to TDS. The

2. What is the full form of TRACES?

TRACES refers to TDS Reconciliation Analysis and Correction Enabling System.

3. What is the purpose of TRACES?

TRACES was established to help deductor of tax in the easy filing of returns, statements. To encourage the users to comply.

4. What is Form 26AS from TRACES?

Form 26AS from TRACES has the following details:

-

- Tax deducted by deductors

- Tax collected by collectors

- Payments for Advance tax

- Refunds received in a financial year

- Self-assessment tax

- Regular assessment tax

5. What is the deductor?

A deductor is a person who is liable to deduct tax on sources at the time of making the payment.

6. Who can make the user id at the TRACES?

Any person who is liable to deduct TDS or collect TCS can register on the TRACES.

7. Is TAN required to register a person on the TRACES?

Yes, TAN is mandatory for registering a person on the TRACES.

8. What is an admin user?

An admin user is a person registered on the portal, who is responsible for deduction of tax and other TDS related activities.

9. Who can register the sub-user on the TRACES?

An admin user can register the sub-user on the TRACES portal.

10. How many sub-users can be registered on the TRACES?

You can register only 4 sub-users on the TRACES, which are appointed only by the admin user.

11. Can I view Form 26AS on TRACES?

Yes, a taxpayer can view his 26AS on TRACES, through the Income Tax Portal or by registering himself on TRACES.

StairFirst is an e-service platform which provides company registration, corporate compliances, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details