The world has been stung by Coronabite and yes it’s a Pandemic. The brave ones are trying not only to save lives from coronavirus but also revive the lifeline of their loved ones. In such an attempt, the Hon’ble Finance Minister of India announced the economic stimulus package of Rs. 20 lakh Crores on 13th May 2020. It is very well named as “AtmaNirbhar Bharat”, which would be and should be the key mantra for survival and growth in times to come. This package can very well be defined as COVID relief package.

The economic stimulus package is hailed by the Hon’ble Prime Minister as a stepping stone to make AtmaNirbhar Bharat (Self Reliant India). Economy, Infrastructure, System, Vibrant Demography and Demand are described as five pillars of the AtmaNirbhar Bharat. The Hon’ble Prime Minister also gave the nation a mantra “Vocal for Local” to encourage local industries and services.

The COVID relief package provided by the Government is of Rs. 20 lakh Crores which is roughly 10% of GDP of India. For now, details of Part-I of the package are shared by the Government. This package has been designed to provide relief to MSMEs, employers, employees, middle class, labourers.

A. AtmaNirbhar Bharat – Businesses and MSMEs

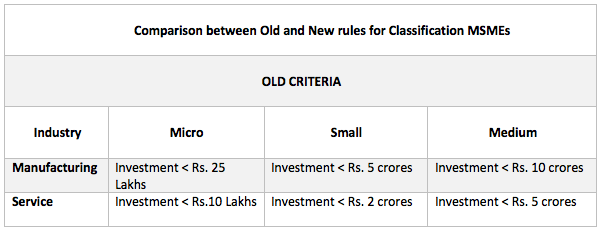

- New Definition of MSMEs

The Government has defined a new definition of MSMEs. Earlier, the definition of MSMEs was based on Investment, now it will also include turnover. The limits of investments are raised to include more businesses in the definition of MSMEs. Now, with inclusion in MSME, the companies can avail of the benefits of MSME Registration.

1. Collateral Free Additional Loan for Businesses and MSMEs

Due to COVID-19 many businesses have taken a hit and have suspended their operations. There is a dire need to make Atmanirabhar Bharat and which requires its lifeline to come back to normalcy. To assist these businesses in restarting their operations, the Government has decided to provide additional working capital. It is one of the biggest benefits of MSME registration.

The loan shall be provided to the businesses at a concessional rate. Some of the features of this scheme are as follows:

- Additional working capital provided shall be 20% of the loan amount outstanding as on 29th February 2020

- The scheme is eligible only for businesses whose account is classified as standard and has:

- An outstanding loan which is less than or equal to Rs. 25 crores, and

- Turnover less than equal to Rs. 100 crores

- No collateral or guarantee to be provided on additional working capital

- The loan will be guaranteed by the Government of India

- The loan shall be of 4 years and a moratorium on principal repayment will be 1 year

- To provide relief to borrowers the interest shall be capped

- The scheme can be availed till 31st October 2020

This is one of the key components of the economic stimulus package and hopefully will make things easier for them.

2. Subordinate Debt to MSMEs

- The Government has decided to provide subordinated debt to MSMEs. This loan to MSME shall be available to only those functioning MSMEs which are NPAs or Stressed

- 4,000 Cr will be provided by the Government to Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE). In turn, CGTMSE will provide partial support guarantee to the Banks.

- The promoters of MSMEs can avail of loans as much as 15% of their equity in the MSMEs. The amount is capped at a maximum of Rs. 75,00,000

Subordinate Debt: It refers to the Debt which is not secured by any mortgage or collateral security.

NPAs: NPAs refer to Non-Performing Assets, the accounts which fail to service interest of their loan are classified as NPAs.

3. Equity Infusion for MSMEs

The current Market situation has caused a shortage of equity for many MSMEs. Many businesses are finding it difficult to raise equity from the market.

Therefore, the Government has decided to establish a fund of funds that will operate through Mother Fund and various Daughter Funds.

The fund of funds shall be established with Rs. 10,000 crores, to provide equity support to MSMEs. It is expected by the Government by this method of operating a fund of Rs. 50,000 crores can be mobilized and be a big benefit of MSME registration in India.

4. No Global Tenders for Procurement

Indian MSMEs were facing real difficulties in competing with foreign businesses. To take a step towards Aatma Nirbhar Bharat, the government has decided to stop global tenders. The Government will not issue tenders for foreign businesses for procurements worth up to Rs. 200 crores. It might appear a relatively smaller number in 20 lakh crores financial package but will help Indian industry a long way. A true measure for making Atmanirbhar Bharat

It is a really helpful measure adopted by the Government of India, to boost the MSMEs. This decision will greatly help businesses who were earlier not able to compete in the international market.

5. E-Markets for MSMEs

The government has decided to promote e-Market for MSMEs. Due to the COVID-19 situation, it is not possible to organize trade fairs or exhibitions.

Setting up this type of market will have future bearings. Now, buyers from anywhere will be able to assess the products. Also, earlier those businesses who were not able to be part of these market places will be promoted.

6. Fintech based lending

Fintech refers to Financial Technology. The Government has decided to adopt the Fintech model for lending. In this model, the loan is given based on the behaviour of the borrower. The behaviour and transactions of the MSMEs on the e-Market will play a crucial role.

7. Quick Release of Funds

The Government has decided to quicken the process of disbursing funds. Therefore, all the funds which are receivable by MSMEs from Government or Central Public Sector Undertakings will be released in 45 days.

The Government of India believes that Economic stimulus package/COVID 19 relief package should be a strong stepping stone towards Atmanirabhar Bharat

If you want to know more about MSME Registration process and fee, then visit our article:

https://stairfirst.com/blog/msme-registration-online-india/

B. Support to Businesses through EPF IN AtmaNirbhar Bharat

The Government has decided to extend the support under Pradhan Mantri Garib Kalyan Package (PMGKP). The Government was paying provident fund amount in the EPF account of the businesses.

The 12% share of employee and 12% share of employer both contributions were made by the Government.

It is decided to continue the scheme for another three months i.e. June, July and August. This move intends to bring about liquidity relief of Rs. 2,500 crores. It is important to note that this scheme was applicable to organisations which had a strength of upto 100 and whose 90% employees had salary below Rs. 15,000.

C. Reduced EPF Contribution

It is decided to reduce the monthly employee provident contribution made by both the employers and employees. The existing rate of 12% is reduced to 10% of both employer and employee. This reduction has been given effect for the next three months i.e. June, July and August.

This benefit is not available to Central and State’s Public Sector Undertakings. Businesses that are availing of EPF support under PMGKP are not eligible.

This scheme is welcomed step by the Government, as it has provided extra liquidity to the enterprises and employees both. It is estimated by the government that this move will provide liquidity of Rs. 6750 crores. These benefits provided under EPF schemes are believed to bring necessary impetus under Atmanirabhar Bharat.

If you want to check your PF balance online, then follow steps in our article below:

https://stairfirst.com/blog/how-to-check-pf-balance/

D. Special Liquidity Scheme for NBFCs/HFCs/MFIs IN AtmaNirbhar Bharat

In these tough circumstances, investors are also losing their trust and enthusiasm in the market. This has led to a shortage of liquidity which is making it difficult for NBFCs/HFCs/MFIs.

To create confidence in investors in the market the Government has decided to invest in these markets. The investments will be made primary and secondary market transactions in investment-grade debt paper. The investment will be made up of Rs. 30,000 crores. We should note that securities under the scheme would be 100% guaranteed by the Government of India.

E. Partial Credit Guarantee Scheme 2.0 for NBFCs/MFIs

To provide liquidity of Rs. 45,000 crores, the government has decided to extend the Partial Credit Guarantee Scheme. The scheme shall be eligible for Non-Banking Finance Companies (NBFCs), Housing Finance Companies (HFCs) and Micro Finance Institutions (MFIs). In case of a situation of any loss, the first 20% shall be borne by the Government of India.

F. Liquidity Injection for DISCOMs

The fall commercial demand for electricity has led to a loss in revenue of power distribution company. At present, the power distribution companies need to pay 94,000 crores to Power Generation and Transmission Companies.

The Government has decided to provide aid electricity distribution companies through Power Finance Corporation (PFC) and Rural Electrification Corporation (REC). The aid shall be given Rs. 90,000 crores in two equal instalments.

The aid received shall be used in payment of the amount due to power generation and transmission companies. It has also been decided that the Central Public Sector Undertakings (CPSUs) and Power Generation Companies (GENCOs) will give rebates to DISCOMs. The rebate is given under COVID relief package/economic stimulus package with an intent that benefits be passed to the end consumer.

G. Relief to Contractors

Like every other business, the contractors have also taken a hit during the period. It has been decided by the Government to extend the deadlines for completion of obligations by 6 months.

This extension shall be provided by the Central Government Agencies such as Railways, Ministry of Road and Transportation, Central Public Works Department (CPWD).

This extension shall apply to construction works, goods, and services contracts including concession agreements. Contracts for completion of work, intermediate milestones are also included.

H. Relief to Real Estate

The current situation has led to a high risk of defaulting on the timelines define by the RERA (Real Estate Regulatory Authority). The Government has decided to ask State Governments to invoke the “Force Majeure” clause.

It is been decided to extend the registration and completion date of all registered projects by 6 months. The period can be extended up to 3 months depending on the situation. Also, it has been decided to extend the date of other compliances.

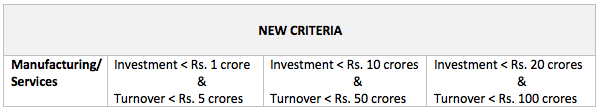

I. Taxation Related Relief Measures

The Government has also tried to provide benefits to people by relaxing compliances under the Income Tax Act, 1961. It strongly believes that tax reforms are necessary for the mission of AtmaNirbhar Bharat.

- Refund

Immediately release of refund of charitable trusts, professions, proprietorship, partnership, and LLPs and cooperatives shall be issued with immediate effect. It must be noted that this relief is not provided to the companies.

- Extension of Due Dates

The Government has decided to extend income tax return due dates. The income tax return due dates has been extended to 30th November 2020. While the due date of conducting tax audit has been extended up to 31st October 2020.

- Extension of Assessment Dates

It is also decided by the Government to extend the date of all assessment getting barred. The new dates are as follows

- 30th September 2020 extended to 31st December 2020

- 31st March 2021 extended to 30th September 2021.

- Vivad se Vishwas Scheme

Apart from AtmaNirbhar Bharat , It is also decided by the Government to extend the period of Vivad se Vishwas Scheme till 31st December 2020. No additional fee shall be chargeable for such an extension.

- Reduction in the rate of TDS and TCS except rate of TDS on salary

The Government has decided to reduce the rate of tax deducted at source and tax collected at source. The rate of TDS on salary would be unchanged.

The rate of all payments except salary has been reduced by 25%. For example, TDS on professional fee was deducted earlier at 10%, now it shall be deducted at 7.5%.

The rates shall be applicable effectively from 14th May 2020 to 31st March 2021 i.e. end of Financial Year.

This move has been followed by the Government to bring additional liquidity. It is estimated to provide liquidity of up to Rs. 50,000 crores.

“AtmaNirbhar Bharat” – the COVID relief package , should be the key mantra for survival and growth in times to come.

StairFirst is an e-service platform which provides company registration, corporate compliances, GST, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details