This is an era, where there is much emphasis on going green or paperless. The Government of India through NSDL is moving in the same direction and introduced download e pan card online feature.

This also speeds up the process of issuing PAN Cards and also reduces paperwork. This is just an alternative to physical PAN Cards which are being issued by NSDL. e-PAN Card is the same as a physical PAN Card but this is in an electronic format i.e. in soft copy, which can be downloaded from the website of NSDL. This is acceptable similarly to a physical PAN Card, wherever it is required to be presented.

HOW TO DOWNLOAD E PAN CARD ONLINE?

You need to start the process by logging in to NSDL website to download e pan card online:

I. If PAN is Allotted/Changes Confirmed in Last 30 Days:

If PAN has been allotted/changes confirmed in PAN in last 30 days, then you can download e pan card online by following the below-mentioned steps:

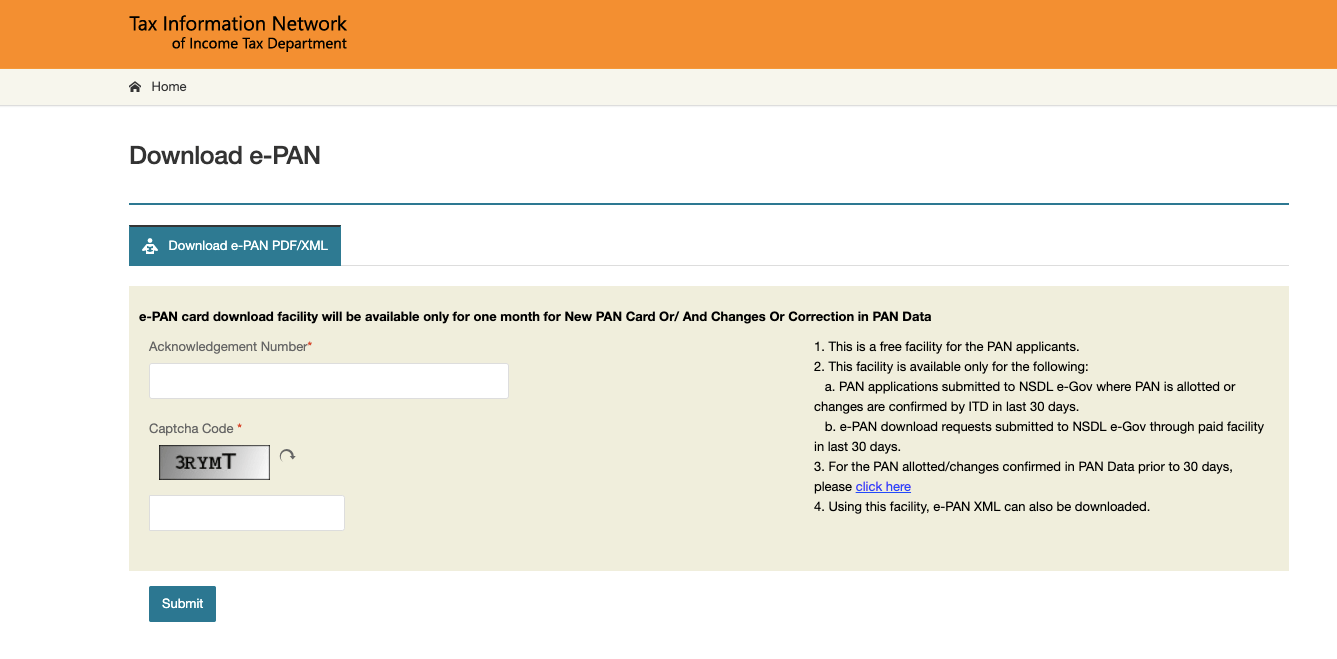

Step – 1: Visit the website of NSDL by clicking here and following window will appear on your screen

Step – 2: Now, furnish the acknowledgement number and enter the captcha in respective fields and press the submit button

Step – 3: Now, following three options for receiving OTP (One Time Password) will appear on the screen:-

- E-mail ID; or

- Mobile Number; or

- Both

Step – 4: Select any of the above options to receive OTP and click on the “Generate OTP” button.

Step – 5: Feed the OTP received and press the “Validate” button.

Step – 6: Thereafter on successful validation, click on the “Download PDF” button to download the e-PAN.

II. If PAN is Allotted/Changes Confirmed Before 30 Days:

If PAN has been allotted/changes confirmed in PAN before the last 30 days, then you can download e pan card online by following the below-mentioned steps. It should be noted that in this case, it is a paid service for which the fee is Rs. 8.26/- (inclusive of taxes)

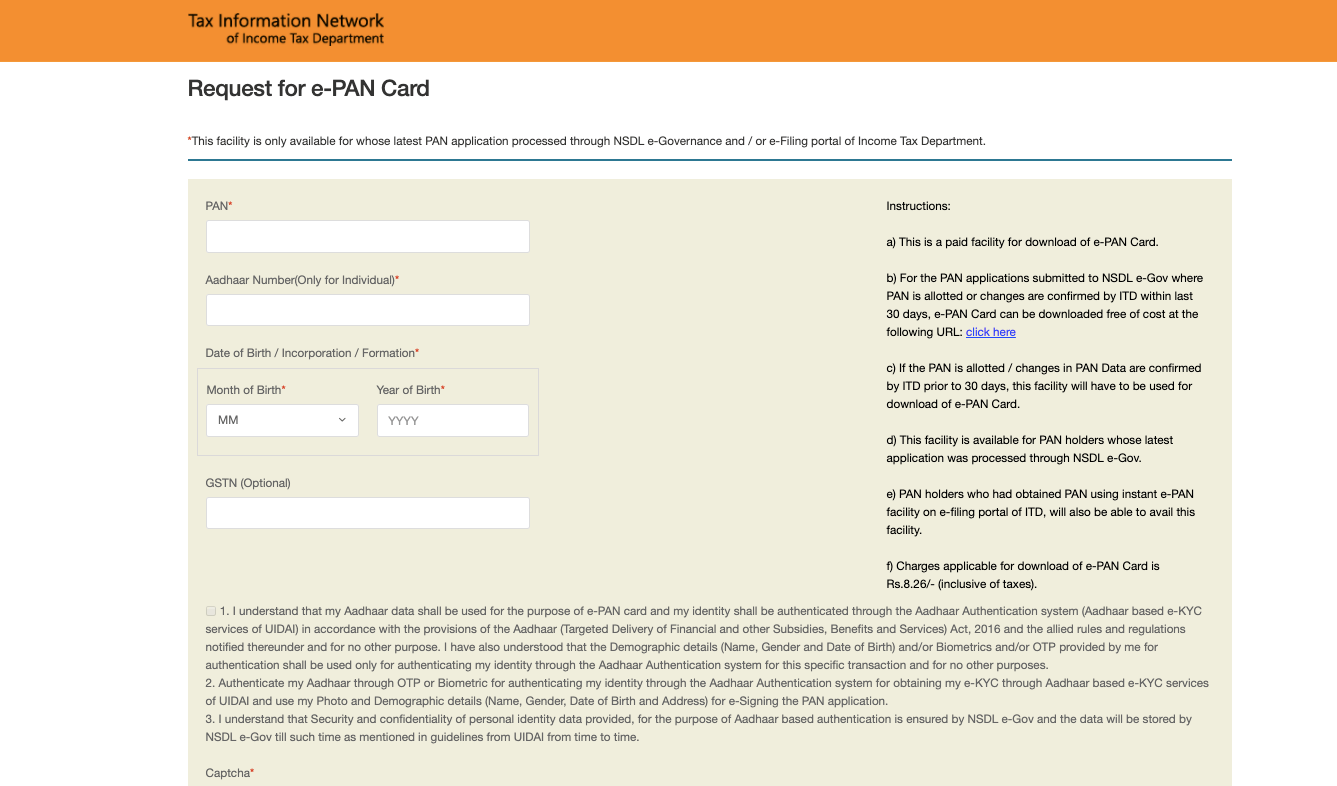

Step – 1: Visit the website of NSDL by clicking here and following window will appear on your screen:

Step – 2: Furnish the required details in respective fields. However, the following details are required to be furnished mandatorily:-

- PAN;

- Aadhar Number (in case of Individual only); and

- Date of Birth/Date of Incorporation/Date of Formation (as the case may be).

Step – 3: Tick the declaration box (in case Aadhar is mentioned) and enter the Captcha.

Step – 4: Press the “Submit” button.

Step – 5: Now, following three options for receiving OTP (One Time Password) will appear on the screen:-

- E-mail ID; or

- Mobile Number; or

- Both

Select any of the above options to receive OTP and also Tick the Declaration “Check Box” and now click on the “Generate OTP” button.

Step – 6: Enter the OTP in the box and choose the “Validate” button.

Step- 7: After successful validation, pay the required fee online and download the PDF of e-PAN by clicking on the “Download PDF” button.

III. Download from UTIITSL Portal:

The facility to download e pan card online is also provided by UTIITSL (UTI Infrastructure Technology and Service Limited) through its website for the following persons only:

1. Who has applied for fresh PAN through UTIITSL; or

2. Who has applied for Changes/Correction in PAN through the UTIITSL website; or

3. Persons who had updated the correct mobile number and e-mail id in PAN records of the Income Tax Department.

Accordingly, any person falling under any of the abovementioned categories may download e pan card online by following the below-mentioned steps:

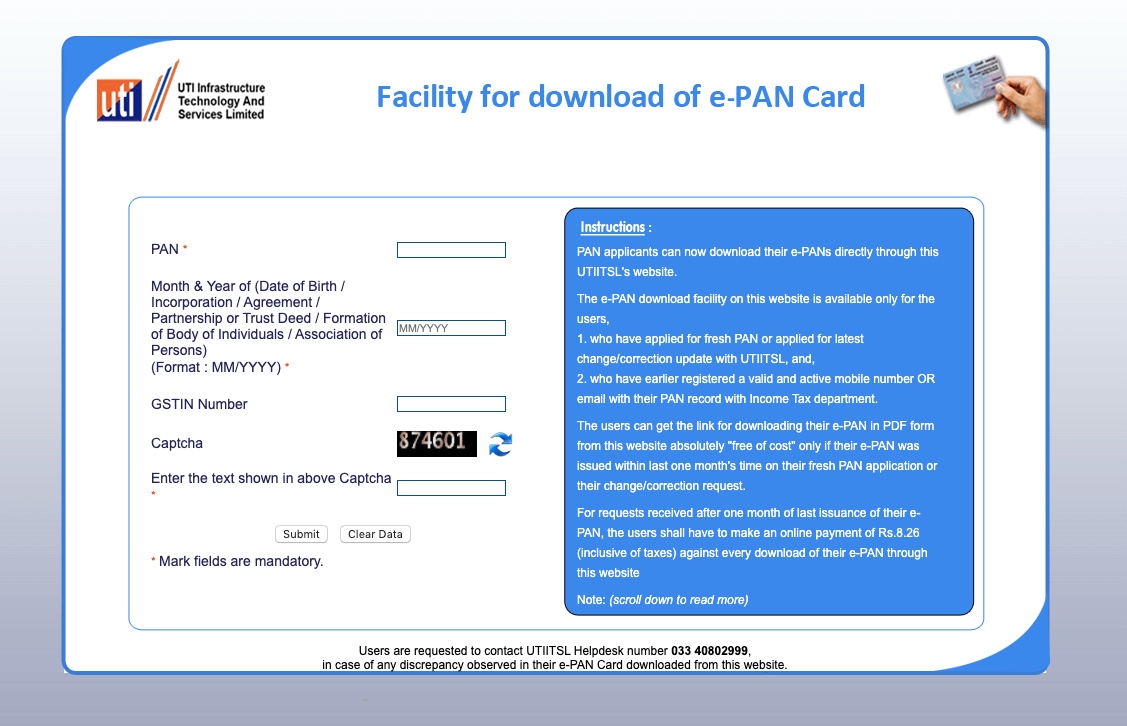

Step – 1: Visit the website of NSDL by clicking here and following window will appear on your screen:

Step – 2: Fill the PAN and Date of Birth/Date of Incorporation/Date of Formation (as the case may be).

Step – 3: Now, enter the Captcha and click on the “Submit” button.

Step – 4: Afterwards, a link will be received by the applicant over the registered e-mail and/or mobile number. By going to the link, it will ask for OTP, thereafter you can download e-PAN.

It shall be noted that the link so received in “Step – 4” can be used for 3 times only to download e-PAN free of cost. Thereafter, the applicant has to pay for the service.

It shall also be noted that this facility on UTIITSL is available free of cost only for the Fresh PAN and Changes/Correction in PAN application is filed during the last one month. In case the application is filed before one month a fee of Rs 8.26/- (inclusive of taxes) shall be payable.

Benefits of e-PAN

Following are the major benefits of holding an e-PAN:

- Easy to download and carry.

- Safe and cannot be theft or lost.

- It can be used wherever there is a requirement of PAN.

- It is economical and faster.

- Eco-friendly as it is in electronic form.

e-PAN Card is same as a physical PAN Card but this is in an electronic format

Frequently Asked Questions (FAQs):

1. Can e-PAN be used anywhere?

Yes, it can be presented wherever there is a requirement of PAN.

2. Do Banks accept e-PAN?

Yes, Banks also accept e-PAN.

3. Is there any fee to download e pan card online ?

No, it is free of cost if PAN is allotted/Changes in PAN confirmed in the last 30 days in case of application through the NSDL portal and in one month in case the UTIITSL portal.

However, if PAN is allotted/Changes in PAN confirmed before 30 days or one month as the case may be then a fee of Rs. 8.26/- (inclusive of taxes) is payable to download e pan card online.

4. I don’t have access to the registered mobile number and E-mail ID, can I still download e-PAN?

No, to download e PAN card online, it is mandatory to have either registered mobile number or E-mail Id. In this case, you can make an application for Change/Correction in PAN through the website of NSDL/UTIITSL and get your present mobile number or E-mail ID registered.

5. I am having physical PAN Card, can I also download e-PAN?

Yes, a person having a physical PAN Card can also download e-PAN.

StairFirst is an e-service platform which provides company registration services. Contact Us for details

1 comment

[…] to downloading your e-PAN, when your PAN card is lost or destroyed you can apply for duplicate PAN card. The process to get […]