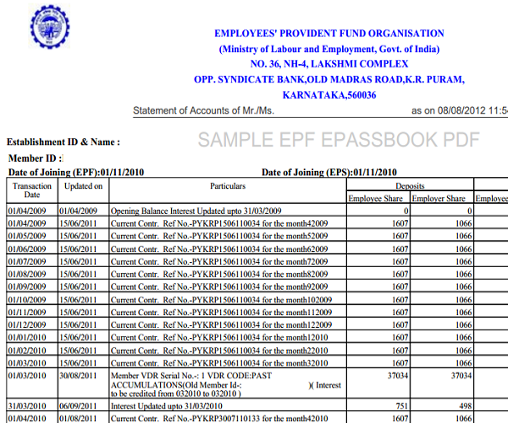

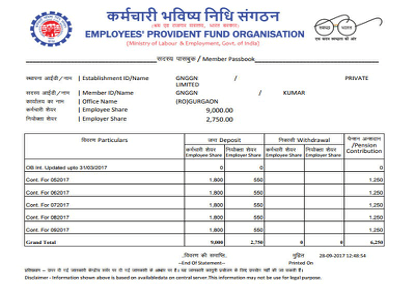

Employee Provident Fund (EPF) passbook is like any other passbook containing all the details of the amount deposited in the bank account. Online passbook of EPF shows you all the records of investments made in that fund. It has details of the amount invested by both the employer and the employee.

ONLINE PASSBOOK OF EPF – BACKGROUND

Under the EPFO Scheme, a continuous or every month contribution must be made by the employer and the employee. The details about such contributions are recorded and maintained in the online passbook of EPF under the EPFO scheme.

The EPF Passbook also contains details of the withdrawals made from the EPF account along with the details of any interest amount credited in the account. The EPF Passbook contains all the details about the name of the Employee, Address, every month contribution amount or any interest amount, beneficiary details, etc.

An employee gets a Universal Account Number (UAN) which is also known as UAN ID created by the employer for the employees. The employee will get EPF Passbook for every account separately if multiple registrations under different employers are done.

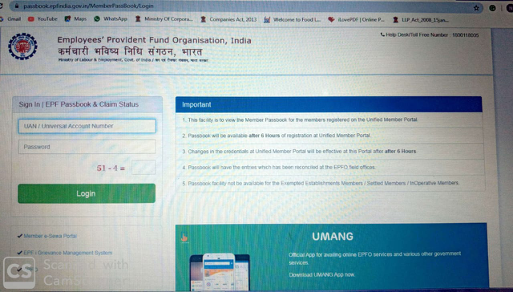

The entire process related to the EPFO Scheme is online now and one can avail of all the services through its online portal. It is known as “UNIFIED PORTAL” also known as “UAN Portal”. To access the facilities available on this portal, the employers have to register and create a user ID & Password. In addition, an employee can register on this portal with the UAN ID provided by the employer.

One such facility available on this online portal is of EPF e- Passbook facility. It is easy to download and check the EPF balance on this portal. It is generally referred to as online passbook of EPF. This entire process helps in providing hassle-free services to the employees. It also promotes the concept of Digital India introduced by the Government of India.

Passbook Applicability

It is important to note that the facility of EPF Passbook does not apply to every type of user on UNIFIED PORTAL. The people who are registered under the EPFO Scheme are known as EPF Members. Also, the EPF Passbook is issued to the EPF members subject to the applicability of the EPF Passbook. The online passbook of EPF is available when you complete the UAN registration on EPFO portal. The passbook facility is available only after 6 hours of registration or activation completion.

Registration & Downloading EPF Passbook

1. To avail the services of e- passbook and other related services, an employee has to have a UAN ID allotted by the respective employer. In addition, an employee can register on the portal to activate its UAN ID

2. It is important to note that only after 6 hours of registration and UAN ID generated, the facility of EPF Passbook will be available to the members

3. The facility to log in is available through an app called “UMANG” and also by entering the login credentials on the portal. One can visit the website (www.epfindia.gov.in) under the head of services

4. The facility of e- passbook is available under the head of the service on the employee portal and one cannot access the passbook facility without a valid UAN Id

5. The online passbook of EPF can be downloaded on the portal and can also be downloaded through a “UMANG” App

6. One can download the passbook for any direction since the registration and the UAN id is generated

Information in EPF Passbook

An EPF passbook whether downloaded from the app or through the portal will have the following:

1. The details of the establishment and the employer along with the employer ID with which the Company is registered

2. The details about the employee like name, UAN ID generated at the time of registration under EPFO and address

3. Percentage and amount of contribution made by the employer and the employee

4. Details related to withdrawal and deposits made during the month

5. Details about the branch of EPFO and its type will be mentioned

6. Time of printing

PROCEDURE TO DOWNLOAD EPF PASSBOOK

The Online Passbook of EPF can be downloaded using the app “UMANG”. The following is the procedure and the steps of downloading the EPF Passbook:

1. Visit the website (www.epgindia.gov.in)

2. Enter the UAN ID & password generated and allotted at the time of registration on the EPFO Portal. The UAN ID will be a 12-digit number and that has to be entered

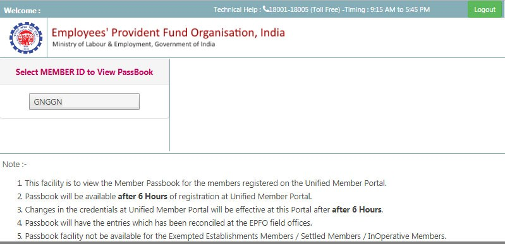

3. Click on “LOG IN”. After this member ID has to select the member ID as shown in the figure to view passbook under the head of “services”

4. Once the Member ID is selected, the EPF Passbook will be opened and one can view and even download the EPF Passbook. The passbook will open in a new tab in PDF Format.

5. Once it is opened in a PDF Format, the employee or the member can print the online passbook of EPF

FREQUENTLY ASKED QUESTIONS

1. How can one download Online Passbook of EPF through a mobile App?

Yes, you can download the EPF Passbook through the app called “UMANG”. Install the app on your mobile phone from the play store. Enter the UAN ID and the password under the head of “Services” to Employees.

Select the option “DOWNLOAD PASSBOOK” and it will appear in PD Format. You can save it or can print the same.

2. Do I have to enter any password to open the PDF Format of Passbook?

No, the password is not required to open the passbook as it automatically opens in a PDF Format in a separate tab

3. What if I lost my UAN Number and would like to see the balance in my passbook?

If you have lost your UAN Number or you don’t remember, then you can give a missed call on 011-22901406 from your registered mobile number which is associated with UAN ID. You will receive a message of your EPF Balance from the department.

4. What if I don’t have UAN ID, can I still avail the facility of EPF Passbook?

No, without UAN ID you cannot avail the facility or view your online passbook of EPF. The id is required to view the passbook on an online portal or a mobile app.

5. Who verifies the entries in the EPF passbook and what is the frequency of such validation?

The EPFO offices confirm all the entries made in the EPF Passbook and the same is updated every month. It is done by the respective EPFO Office under which your UAN ID is processed or registered.

6. Can I avail EPF Passbook provided online just after the registration?

No, it is not possible to avail the facility of online EPF Passbook as it takes 6 hours after the registration on the EPFO Portal and after the UAN ID is generated.

7. Who does not have access to EPF Passbook?

The EPF members can only have access to the facility of EPF Passbook through an online portal or the UMANG App. The Exempted Establishments Members, Settled Members and Inoperative Members do not have access to the EPF Passbook facility.

8. How does a non-member have access to the EPF Passbook facility?

No, as per the rules only a member who has a member ID can have access to the EPF Passbook facility.

9. Who are settled members as per the provisions of the EPFO Scheme?

Settled members as per the provisions of the EPFO Scheme are the members whose EPF claim has been processed by the Department and the amount of claim is also transferred to their respective bank accounts. Such members cannot have access to the EPF Passbook facility after the settlement of their claims.

10. Who is covered under the category of “Exempted Establishment Member”?

Every month the EPFO department releases a list of exempted establishments after the evaluation of their record. The list has the establishment codes as well so that once they check their status and verify the same. The exempted establishments are those who have been granted exemptions and create EPF Private Trusts. It is to be noted that only EPFO pays the pension.

StairFirst is an e-service platform which provides company registration, corporate compliances, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details