GST stands for Goods and Services Tax which was introduced in India on 1st day of July of the year 2017. It is a form of Value Added Tax levied on manufacturing, sale and consumption of goods and services and does not differentiate between Goods and Services, therefore the two are taxed at Single Rate. The Government of India has introduced a simple online GST Registration process and steps, which is easy to follow.

ONLINE GST REGISTRATION PROCESS AND STEPS

Following are the main components of GST:

Central GST (CGST): It is levied on intra-state supply of goods and services by the Central Government. It is governed by the CGST Act.

State GST (SGST)/Union Territories GST (UTGST): It is levied on the intra-state supply of goods and services by the State Government and Union Territories. It is governed by the SGST Act/UTGST Act.

Integrated GST (IGST): It is levied on the inter-state supply of goods and services by the Central Government. It is governed by the IGST Act.

The whole process of registration under GST is simple and done online. The process has been made easy compared to the system followed in the previous indirect tax regime. The online GST registration process and steps are detailed in the below steps:

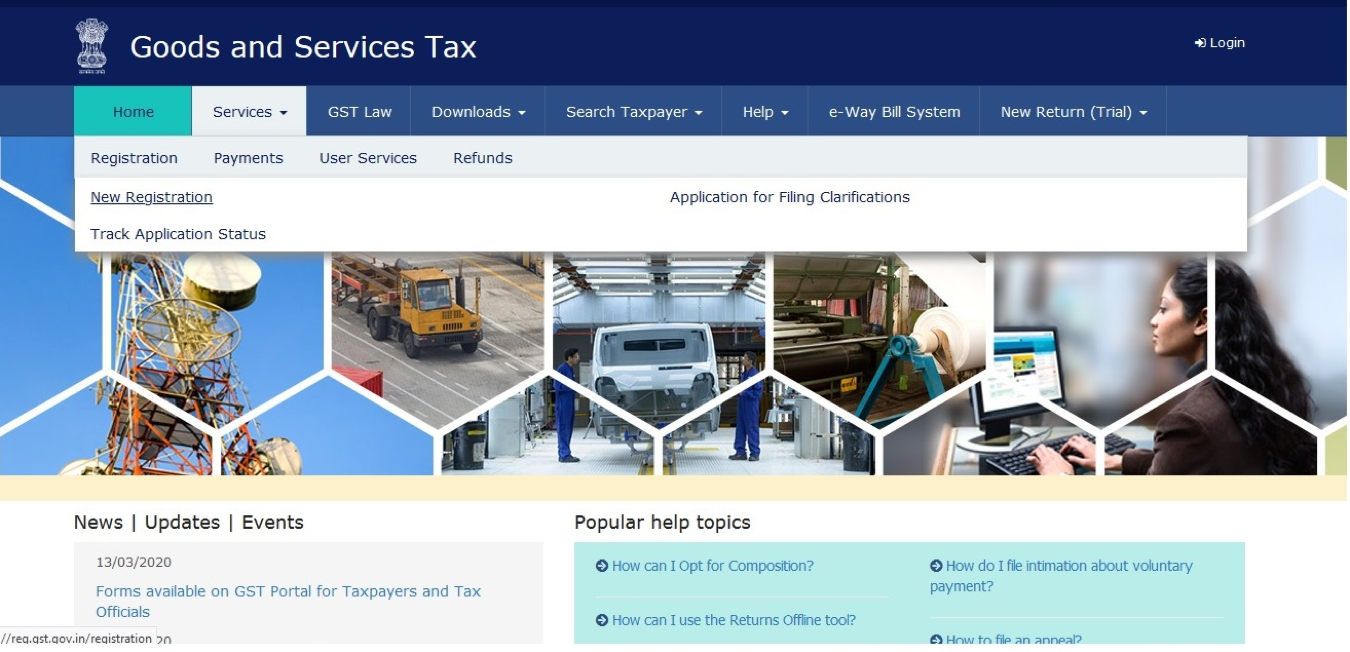

Step 1: Go to https://www.gst.gov.in/

Step 2: Under Service Tab > New Registration

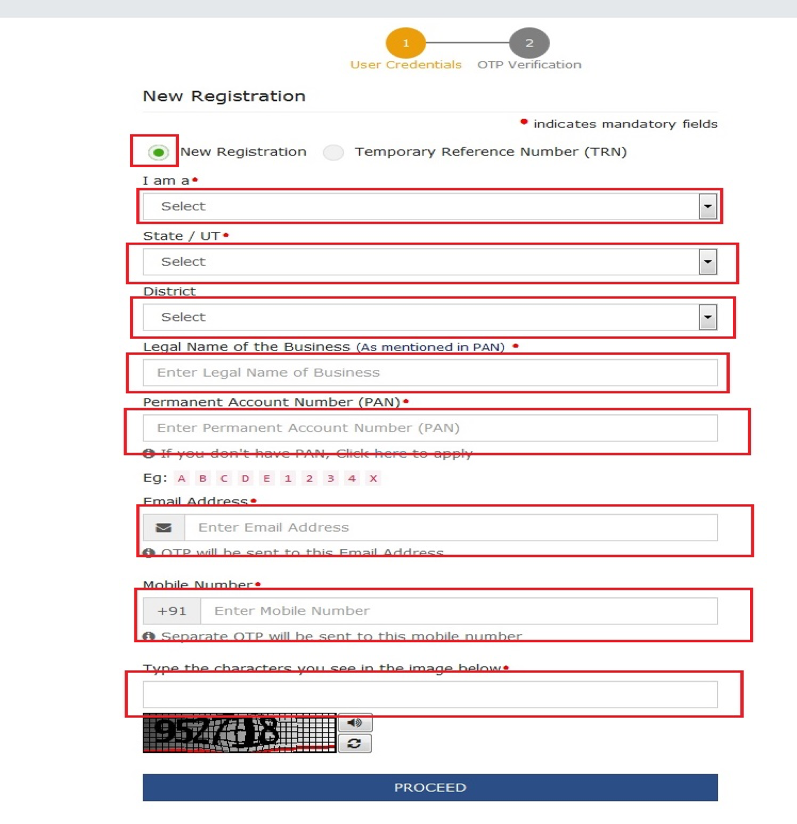

Step 3: In the following screen fill the required details. Please note that it is important to follow the online GST registration process and steps for successful registration.

- In “I am a” tab select your category

- Select your “State”

- Select your “District”

- Enter Legal Name of your business (as mentioned in your PAN Card)

- Then enter your PAN

- Enter e-mail id and mobile number on which you will receive OTP.

Step 4: After filling the above details click on the “Proceed” button.

Step 5: On the next page you will receive OTP (One-time password) on your registered email id and mobile number. Click on “Continue”

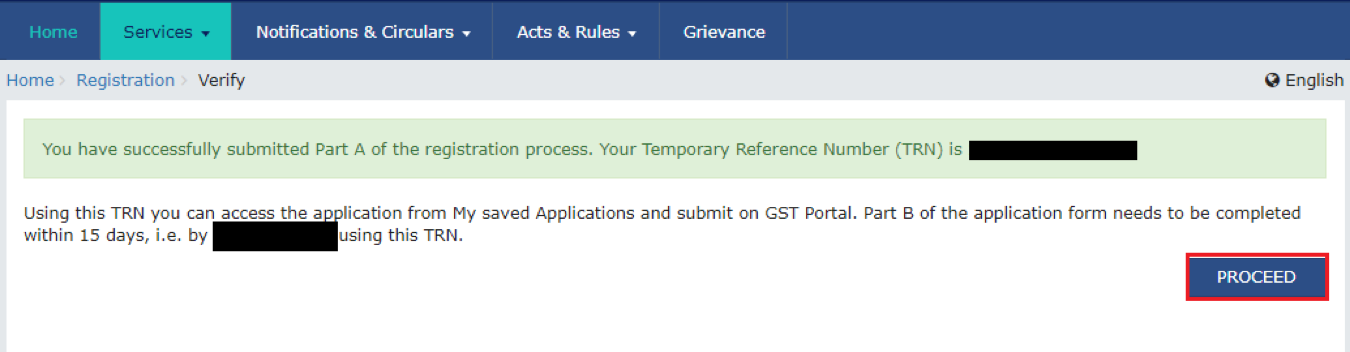

Step 6: On the next screen, your TRN (Temporary Reference Number) will be generated. This can be considered as a first successful step towards online GST registration process and steps

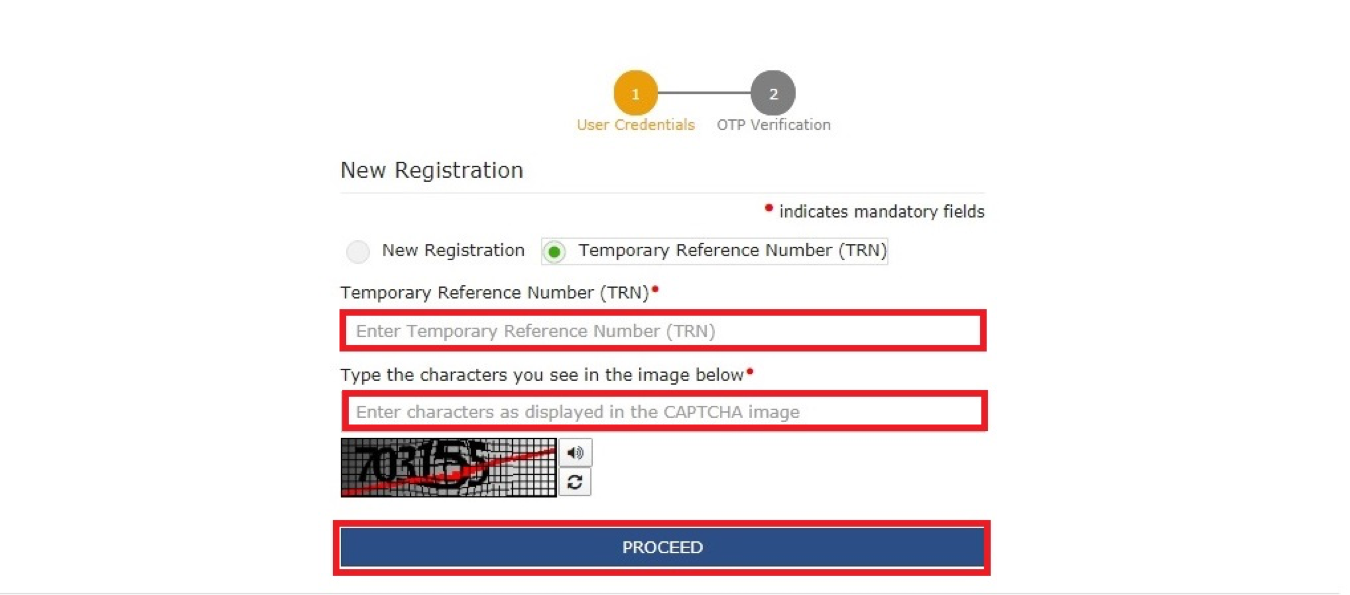

Step 7: Click on the “Proceed” button in the above image. The following screen shall appear. Choose the TRN Option.

Step 8: Two new boxes will appear, add TRN then CAPTCHA click on “Proceed”.

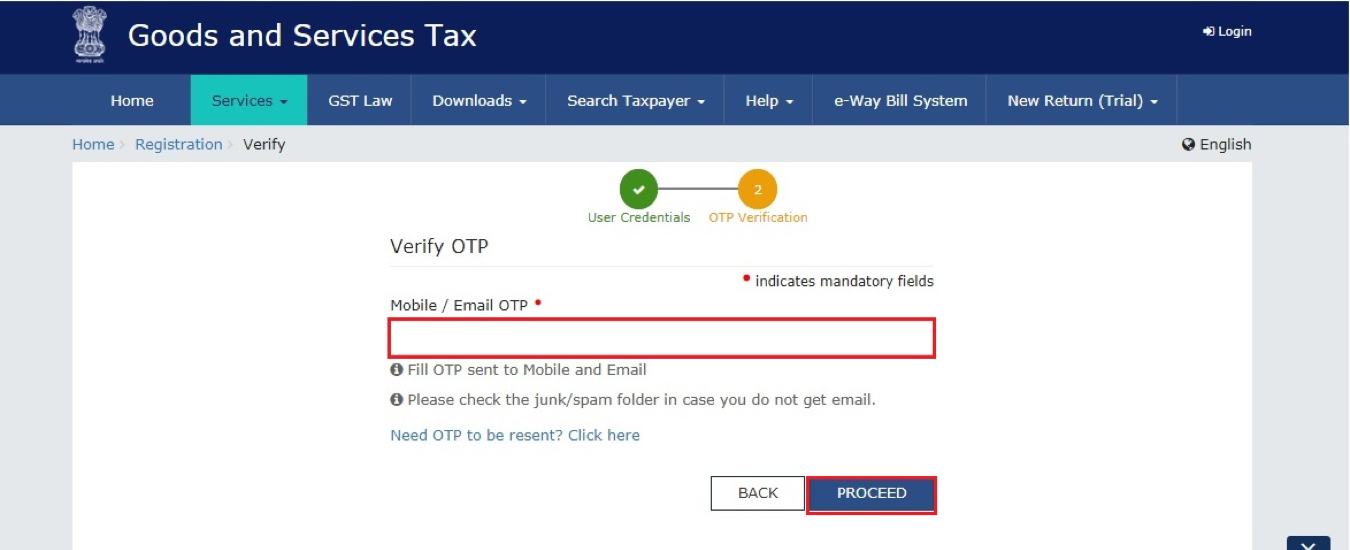

Step 9: On the Next Screen you will receive OTP on your registered mobile number or email id. Enter OTP, then Click on “Proceed”.

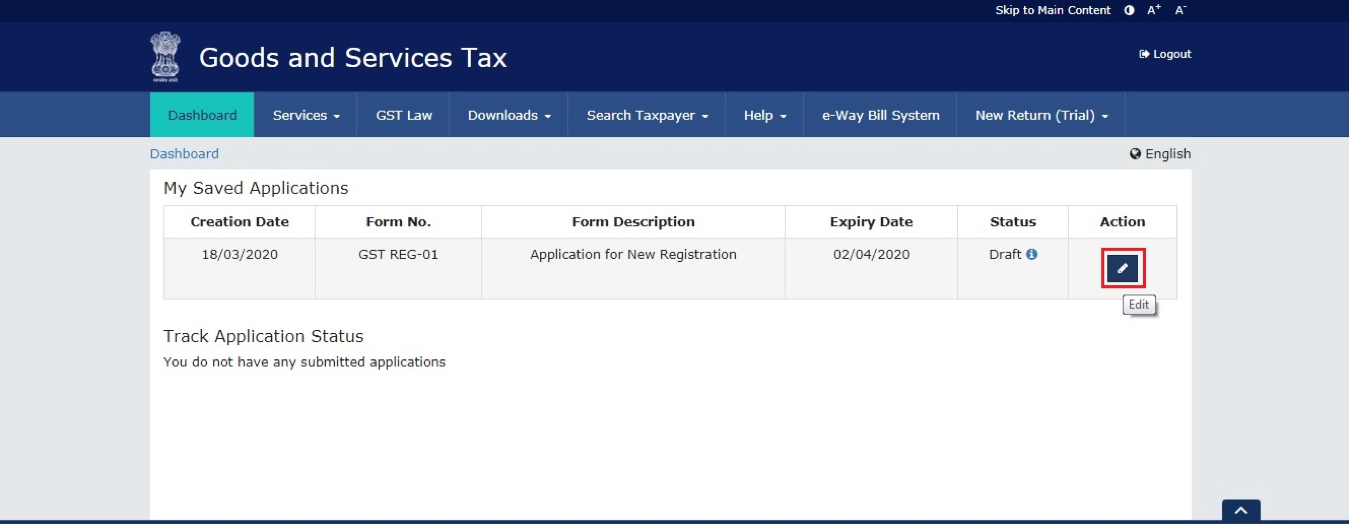

Step 10: On the following screen “My Saved Applications” will appear. Showing application for Registration being created in Form Reg-01.

Step 11: Click on the Edit button under Action.

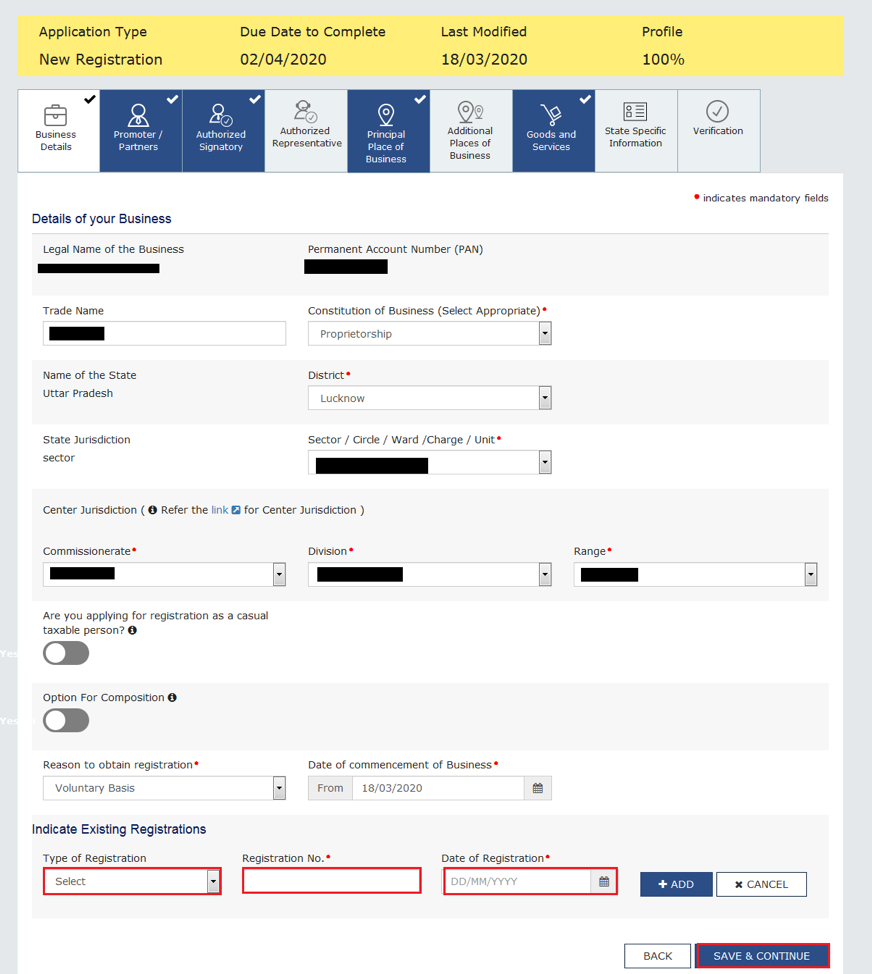

Step 12: The following screen shall appear- Enter Details of your business on the next screen. Select your State and Central jurisdiction based on your place of business.

Step 13: If you have obtained any registration under any other law, those details are also to be submitted.

Step 14: Click on “Save & Continue”. You have to remember everytime to click on this button to move on to next screen in online GST registration process and steps for successful registration.

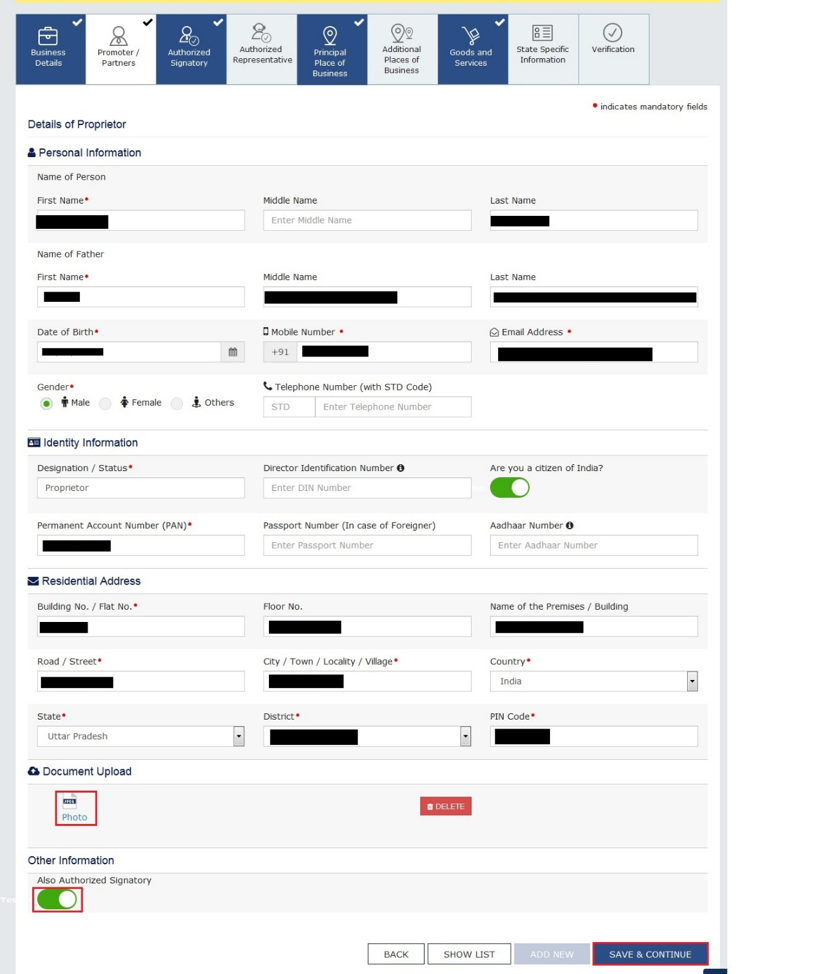

Step 15: On the next page, Enter details of Proprietor/Partners/Directors of your business.

Step 16: As in the above image, select Authorized Signatory at the end of the page for a person who is responsible for GST related filing. Click on “Save & Continue”.

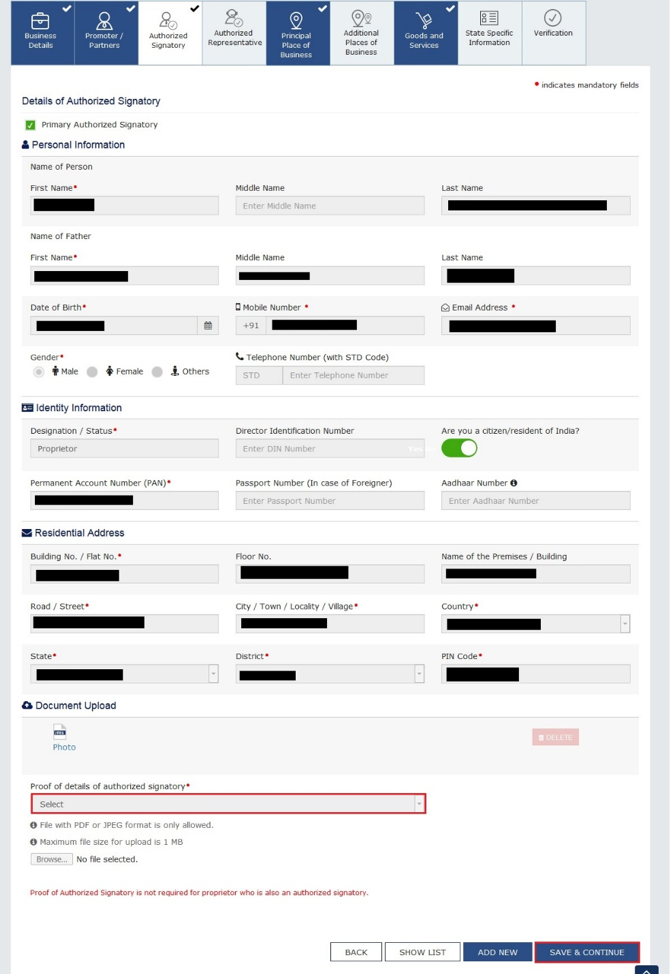

Step 17: On the next page, if you are Company or Partnership firm filing GST registration application. Attach board resolution or Authorization Letter appointing authorized signatory. Click on “Save & Continue”

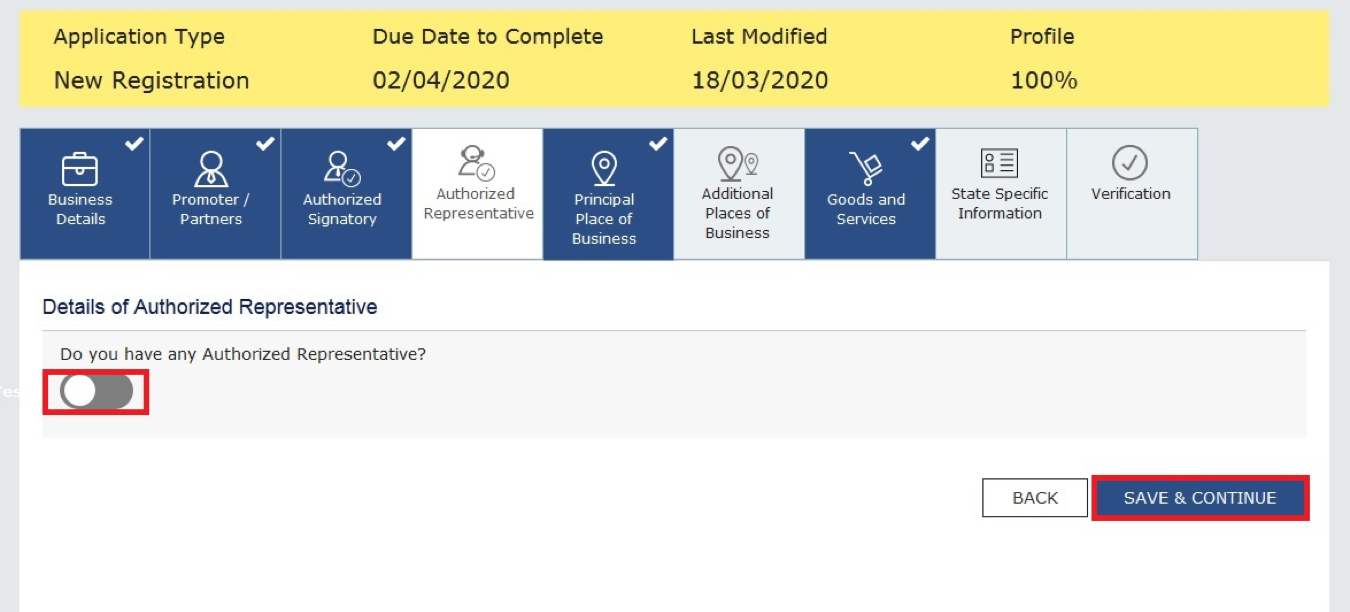

Step 18: On the next page, if you have any Authorized Representative. Add details of the same. Then Click on “Save & Continue”

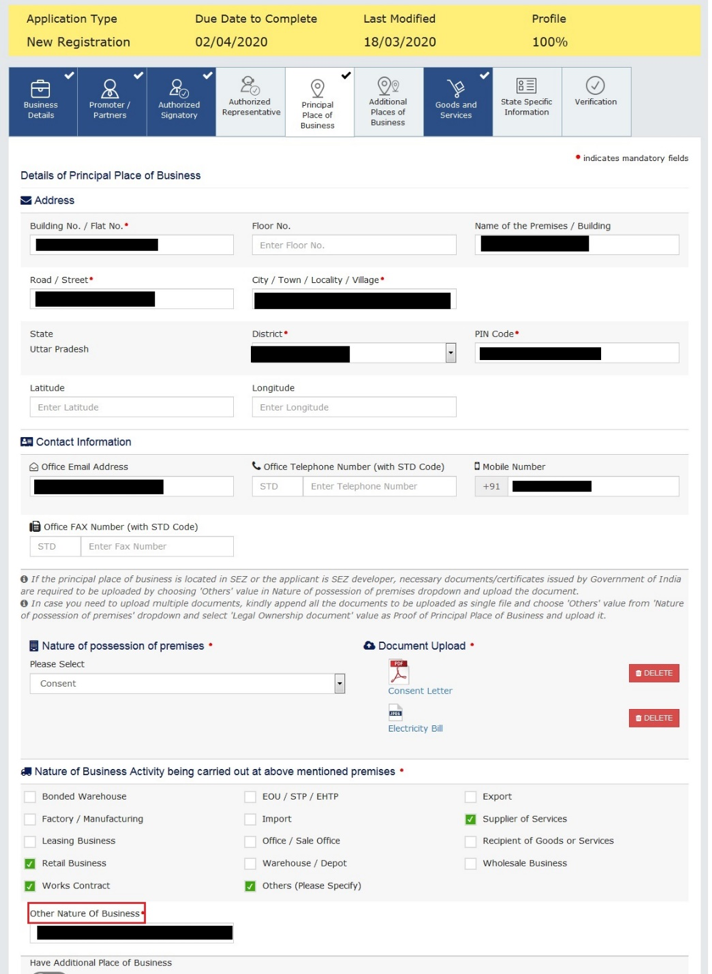

Step 19: On the Next page, Add Details of Principal of Business. Upload Proof of the same, Select Nature of Business Activity. If you have any additional place of business. Click on Tab “Have an additional place of business” located on the bottom left-hand corner of the page. Click on “Save & Continue”

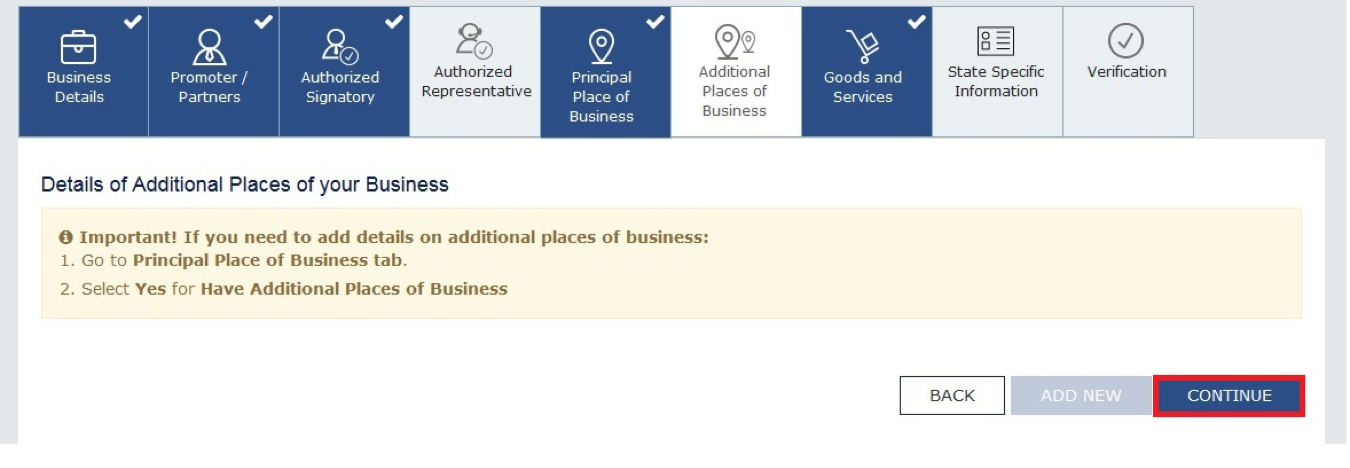

Step 20: On the next screen, if you have any additional place of business, add details of the same. Click on “Continue”.

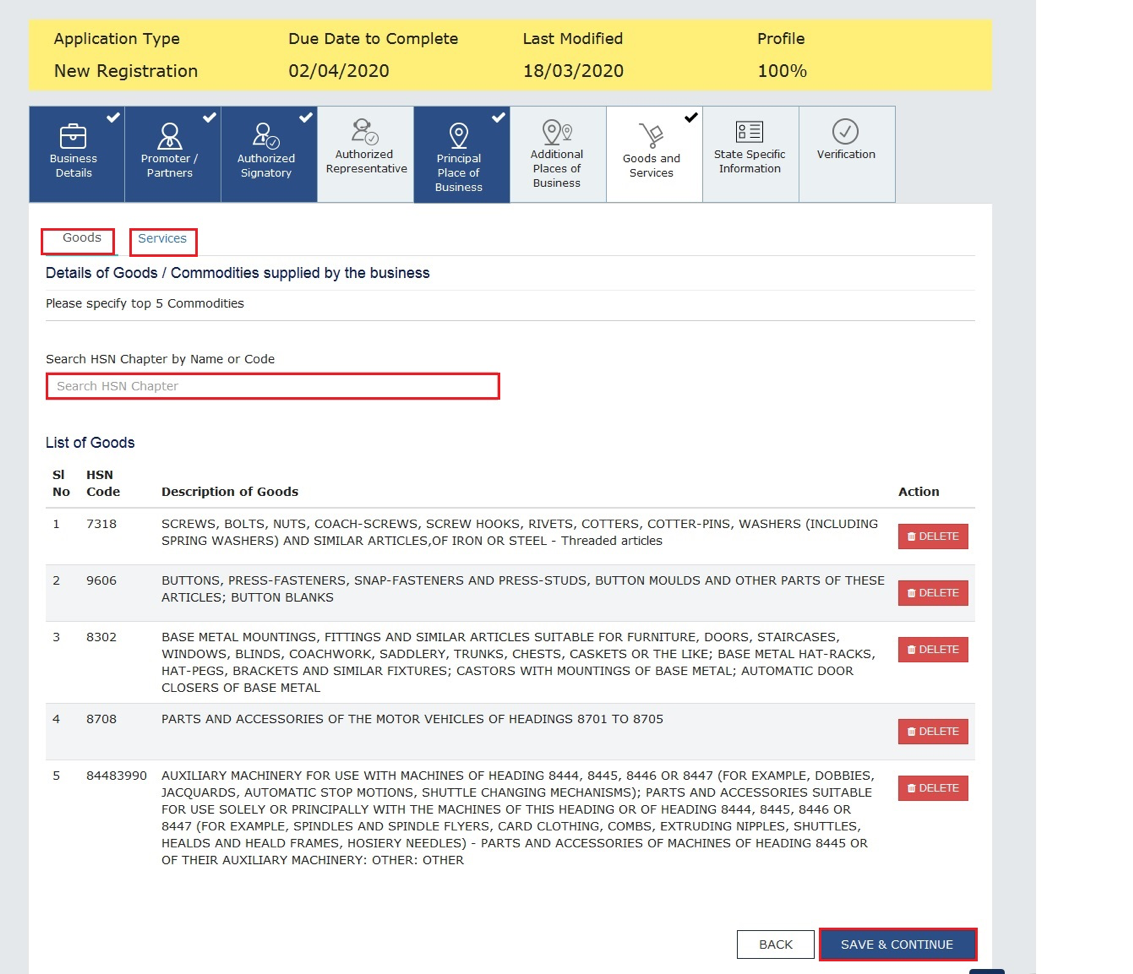

Step 21: Select relevant HSN Codes/ SACs for your business. Click on “Save & Continue”.

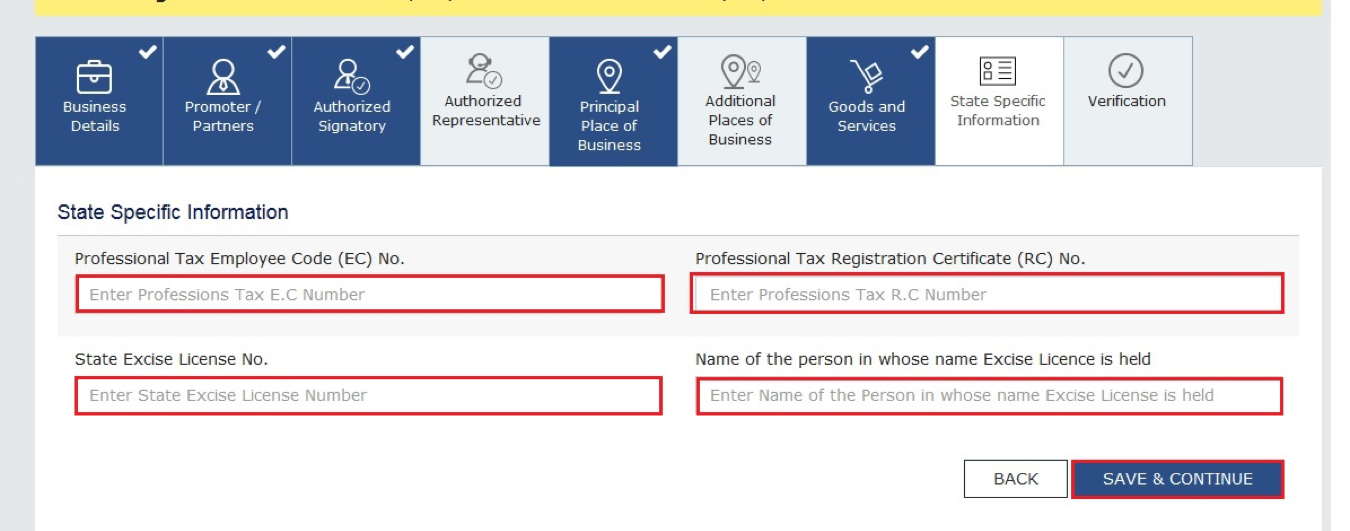

Step 22: On the next screen, enter details of Professional Tax EC/RC. State Excise License no. Then Click on “Save & Continue”.

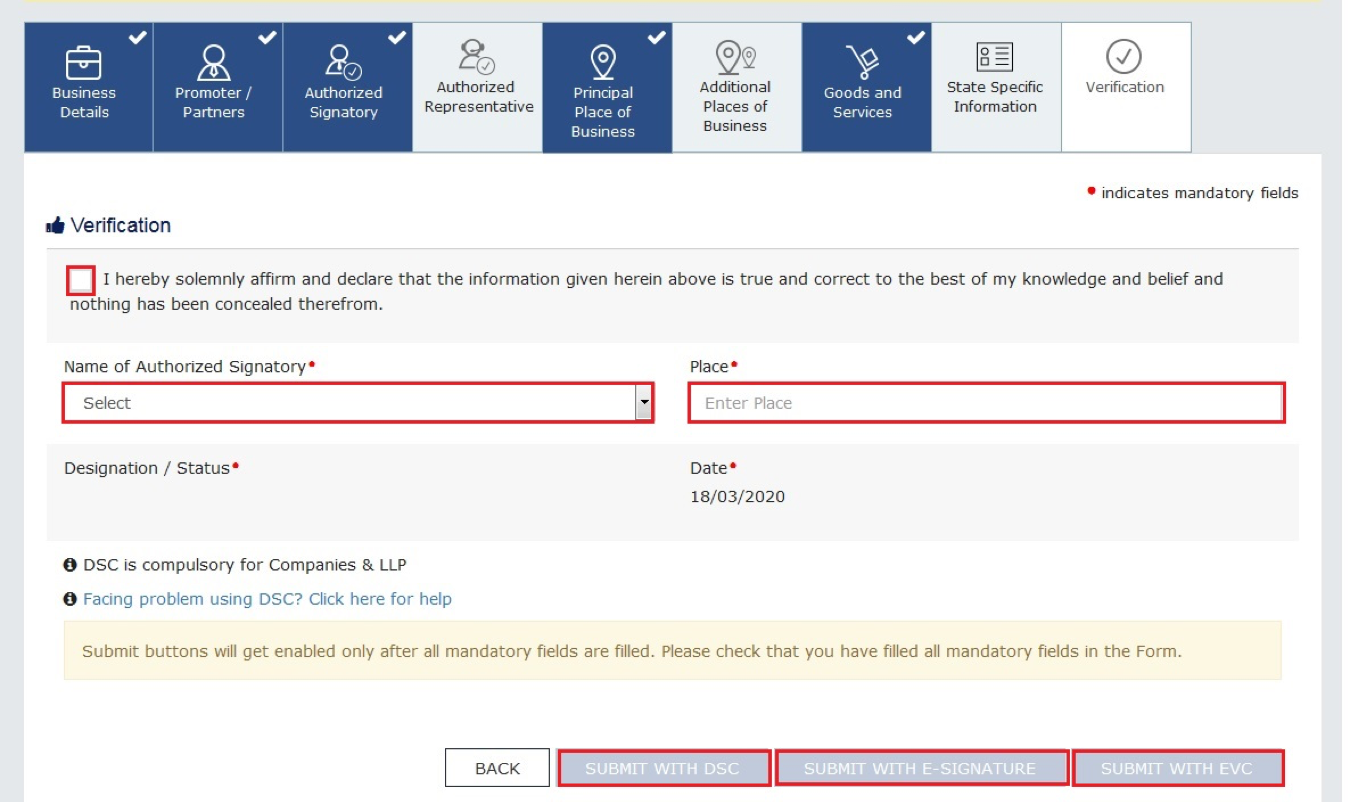

Step 23: Next page, verify your details and submit your application. You can submit your application with EVC for a proprietorship firm. Companies and LLPs have to use DSC for submitting applications.

After submitting your application, you will receive, ARN (Application Reference Number) on your registered Email ID and Mobile Number. ARN is an Application Reference Number, issued by the department for tracking the status of your application. Once the assigned officer is satisfied, it brings the online GST registration process and steps for successful registration towards conclusion and your application will be approved and GSTIN will be issued.

FREQUENTLY ASKED QUESTIONS (FAQs)

- Do I have to pay any fee for GST registration?

No, there is no fee charged by the GST Department for applying and obtaining GSTIN in online GST registration process and steps thereby.

- What does GSTIN stand for?

GSTIN refers to Goods and Services Tax Identification Number

- What is TRN?

TRN is a Temporary Reference Number. It is generated after you start the initial phase of GST registration.

- What is ARN?

ARN is the Application Reference Number. It is used to track the status of your GST application. ARN is received after submitting the final application for GST registration.

- Is it required to file a separate registration for trading and manufacturing by the same entity in one state?

GST is a consumption-based tax. One Registration per state is required for all activities. But, you have the option to obtain separate registration for different businesses.

- Are exemptions in GST based on the area?

No, there is no area-based exemption in GST.

- How much time do I have to register under GST?

An unregistered person has to register in 30 days from the date he is liable to obtain registration.

- Can an unregistered dealer make supply goods to other States if his turnover is below the threshold limit?

No to make, inter-state supply of goods a dealer has to obtain a GST registration.

- Is registration necessary if only NIL rated inter-state supplies are being made?

No, if a dealer is exclusively supplying NIL rated goods inter-state then there is no need to obtain registration.

- Is GST registration also required in the case of the export of services?

Yes, as only NIL rated suppliers are exempted from obtaining registration under GST. Also, exports are Zero-rated supply, hence there is a need to obtain registration.

StairFirst is an e-service platform which provides company registration, corporate compliances, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details