Income Tax Department issues Permanent Account Number (PAN). It is a unique combination of 10-digit alpha-numeric code. The PAN issued by the department is useful in the filing of income tax returns, payment of taxes and bank transactions. As such, it is pertinent for everyone as a taxpayer to know your PAN and also process used for verification of PAN.

Process to know your PAN

This is a service introduced by the Income Tax Department to enable the users to verify details of PAN Card when needed. It is used by financial institutions, banks, or any other person to verify if the information given is correct. A person can use this service to check if the correct information is uploaded on the portal against the PAN.

If you plan to register a company or LLP with MCA, then the SPICe form also validates PAN of directors. The SPICe form is a mandatory form for online company registration in India.

Things you cannot do without PAN in India

There are multiple places where the use of PAN is mandatory in India. It makes it all the more important for you to know your PAN.

You cannot do the following in India if you do not have PAN:

1. Investment in securities: It is mandatory under law to have a PAN card to invest in securities. If you have been planning to invest in mutual funds, they would have to wait for a while.

2. Company Registration: If you want to register a company, then directors should have a valid PAN

3. Director in Company: You cannot become a director in the company without PAN

4. Bank Account: You can open a bank account without PAN but need to fill Form 60

5. Real Estate investment: You are not allowed to buy or sell a property without PAN in India

6. An employee in Company: If you are in the taxable bracket, then you are mandatorily required to furnish PAN

The above list is not exhaustive and but indicative of places where PAN is mandatory. It is important for an individual who is an aspiring businessman or employee to know your PAN.

Steps to “Know your PAN” or “Verify PAN”

The process of verification of PAN is made online on the income tax portal. Any person who wants to verify the PAN details needs to go to the website. Details required to know your PAN on income tax portal are as follows:

-

- PAN number

- Name of the person whose details are to be verified

- Date of birth of the person

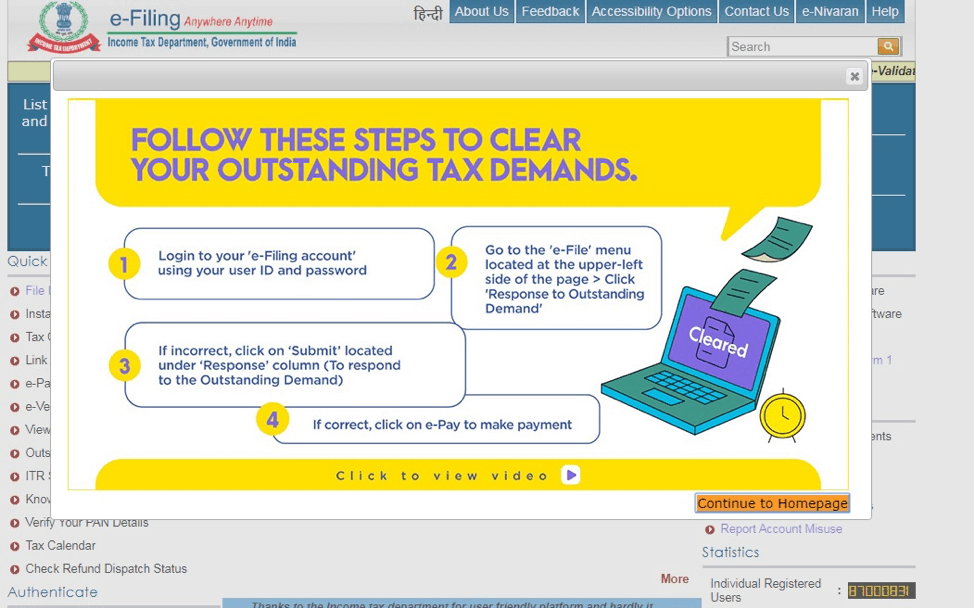

Step 1: In your web browser, go to the Income Tax Portal. The following screen shall appear: Step 2: You need to click on “Continue to Homepage”. The following homepage shall appear:

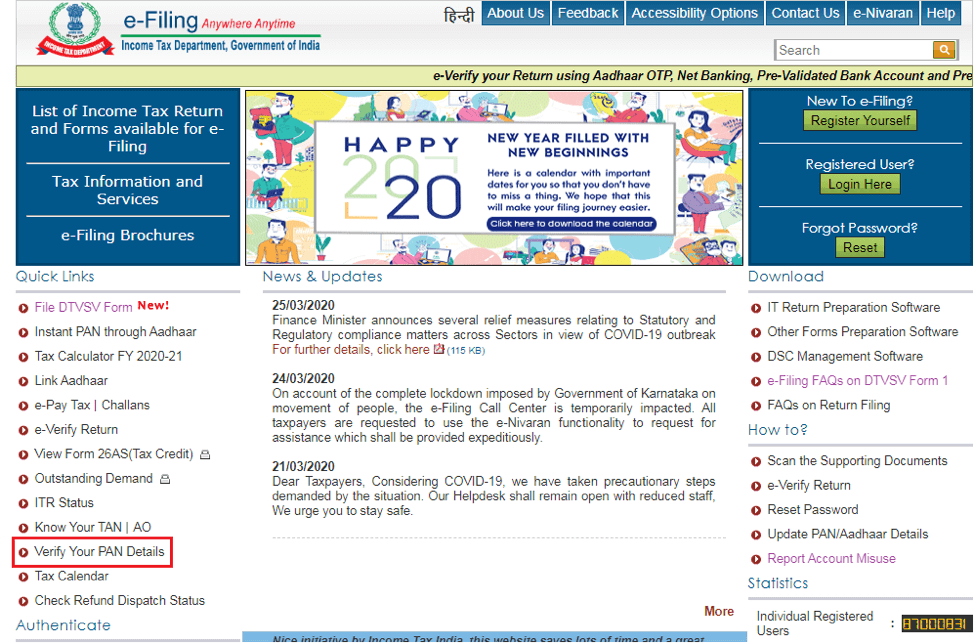

Step 2: You need to click on “Continue to Homepage”. The following homepage shall appear:

Step 3: As you can see there is a link in the red box “Verify Your PAN Details”. Click on the link and the following screen shall appear:

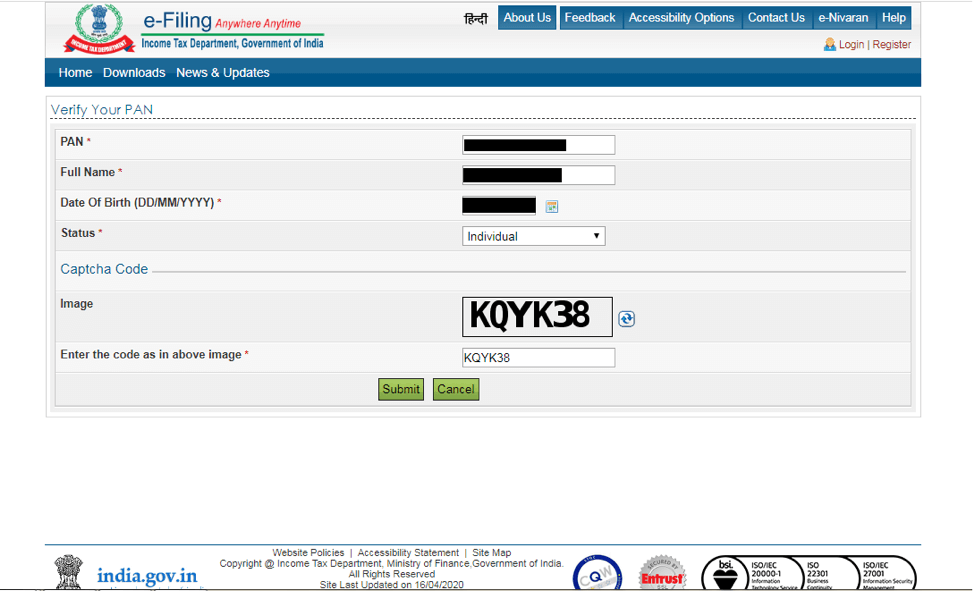

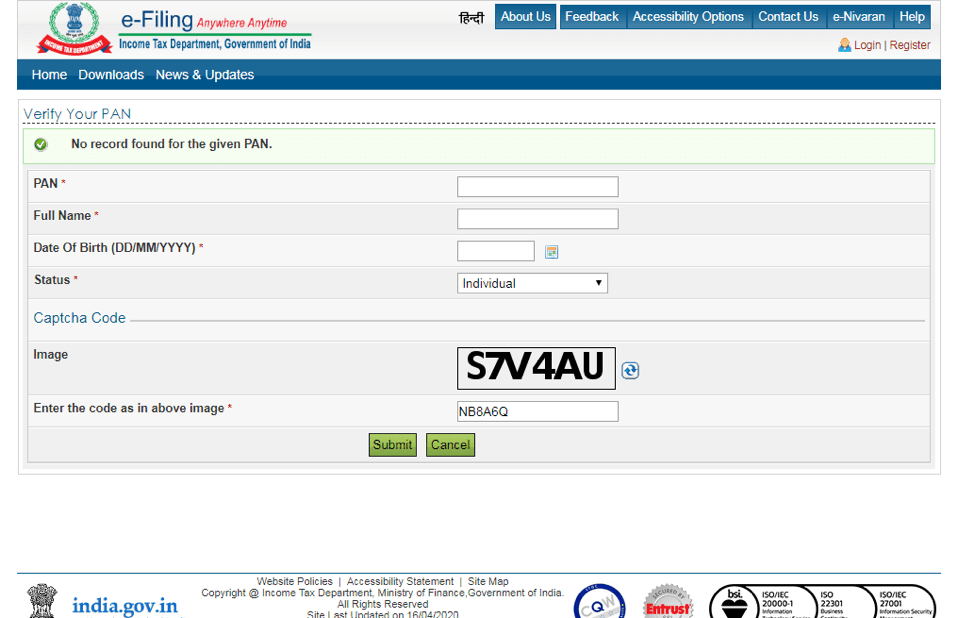

Step 4: You need to fill all the details asked on the above page. After filling details, the select status of the person. Status can be means if a person is a human being select individual, for others as deems fit. Enter the Captcha in the box. Then click on Submit.

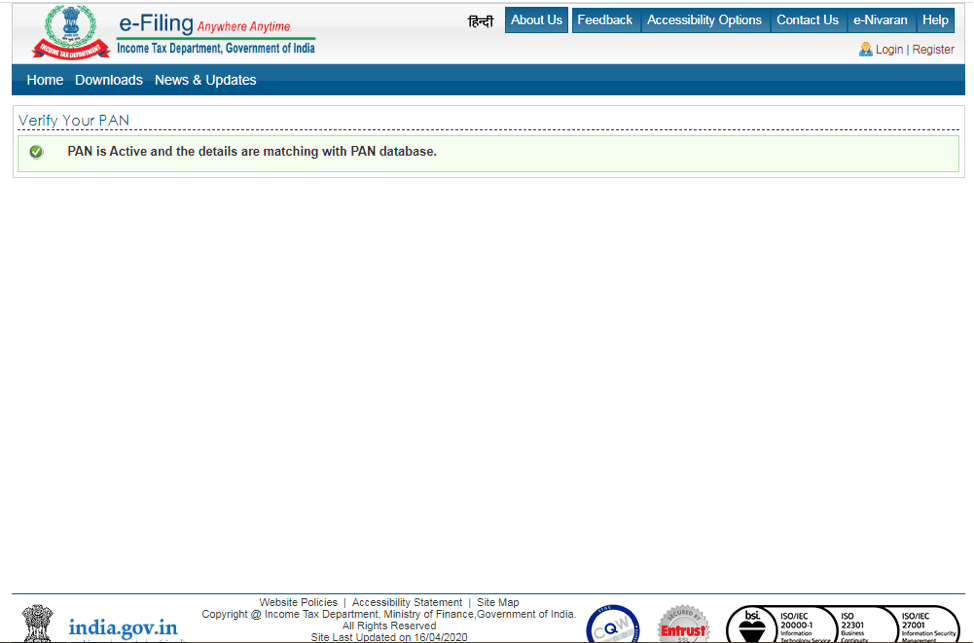

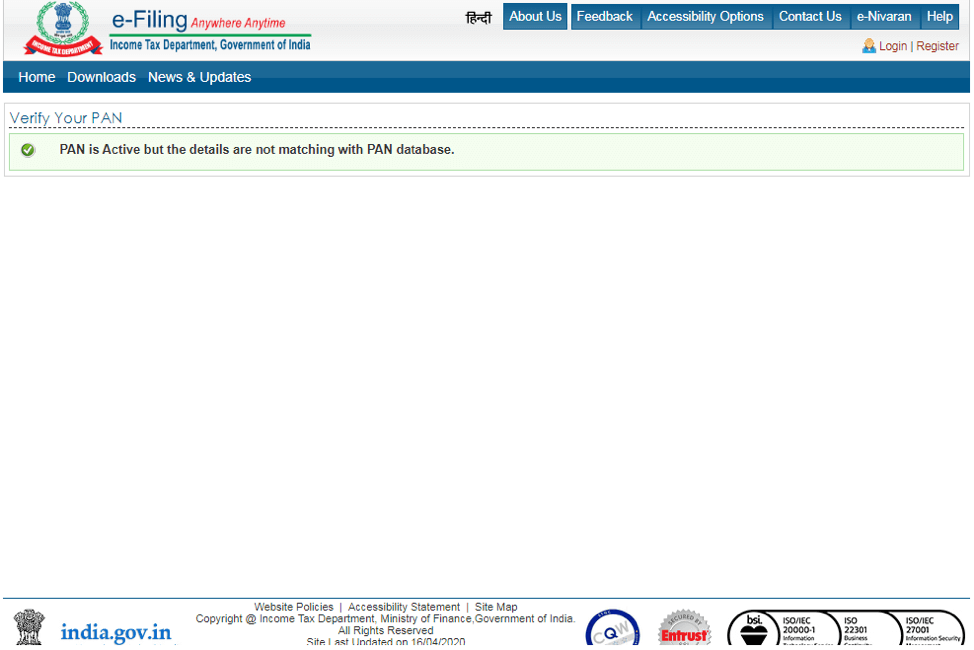

- The following screen will appear if details provided are correct

- If there is any wrong information provided, then the following message will be displayed on the next screen.

- If the PAN number does not exist following screen shall be displayed

FREQUENTLY ASKED QUESTIONS (FAQs)

- How to know your PAN?

The verification of PAN can be done on the Income Tax Portal.

- What are the details required to verify the PAN number?

PAN number, Name of person and Date of birth are required to verify PAN details.

- What is the date of birth of a Company?

The date of incorporation of a company is taken as a Date of birth of the company.

- Can I download my PAN card?

Yes, you may download your e-PAN card from portal

You cannot become a director in the company without PAN

StairFirst is an e-service platform which provides company registration, corporate compliances, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details