Indian laws prescribe different types of audits like an income tax audit, statutory audit, cost audit, GST audit and so on. Section 44AB of Income Tax Act 1961, prescribes tax Audit based on some prescribed conditions. Tax Audit refers to the examination and inspection of the Income Tax Records of an entity for an assessment year. A tax audit is done to ensure whether financial statements submitted by a person give a true or fair view or not.

APPLICABILITY OF SECTION 44AB OF INCOME TAX ACT 1961

The tax audit under section 44AB of Income tax shall be applicable if:

- In the case of business- if during the previous year the turnover of the business was more than Rs. 1 crore.

- In the case of the profession- if during the previous year the gross receipts were more than Rs. 50 lakhs.

- If a person carrying on business or profession and covered under presumptive taxation scheme under section 44AD or 44ADA, claims income less than 8%/ 6% or 50%

- If a person claims income less than the deemed income in PGBP under the following sections:

- Section 44AE- an assessee carrying on the business of plying, hiring or leasing goods carriages

- Section 44BB- an assessee carrying on the business of exploration, etc., of mineral oils

- Section 44BBB- foreign companies engaged in the business of civil construction, etc., in certain turnkey power projects

Note: A person who has opted for presumptive taxation scheme under section 44AD would be liable to get a tax audit done under certain conditions. If 5 years have not elapsed since opting for the scheme and his income exceeds the ceiling for chargeability of income tax, he is liable for tax audit under 44AB of Income Tax Act

Auditor

Tax Audit is done by a Chartered Accountant holding Certificate of Practice and is in full-time practice. Tax auditor needs to furnish audit report in either Form 3CA or Form 3CB where:

- Form No. 3CA: When a person is mandatorily required to get accounts audited under any other law.

- Form No. 3CB: When a person is not mandatorily required to get accounts audited under any other law.

We need to remember that in either of the conditions, tax auditors must furnish Form 3CD which is a part of the audit report under Section 44AB of Income tax Act 1961

FORMS FOR TAX AUDIT (UNDER 44AB OF INCOME TAX ACT)

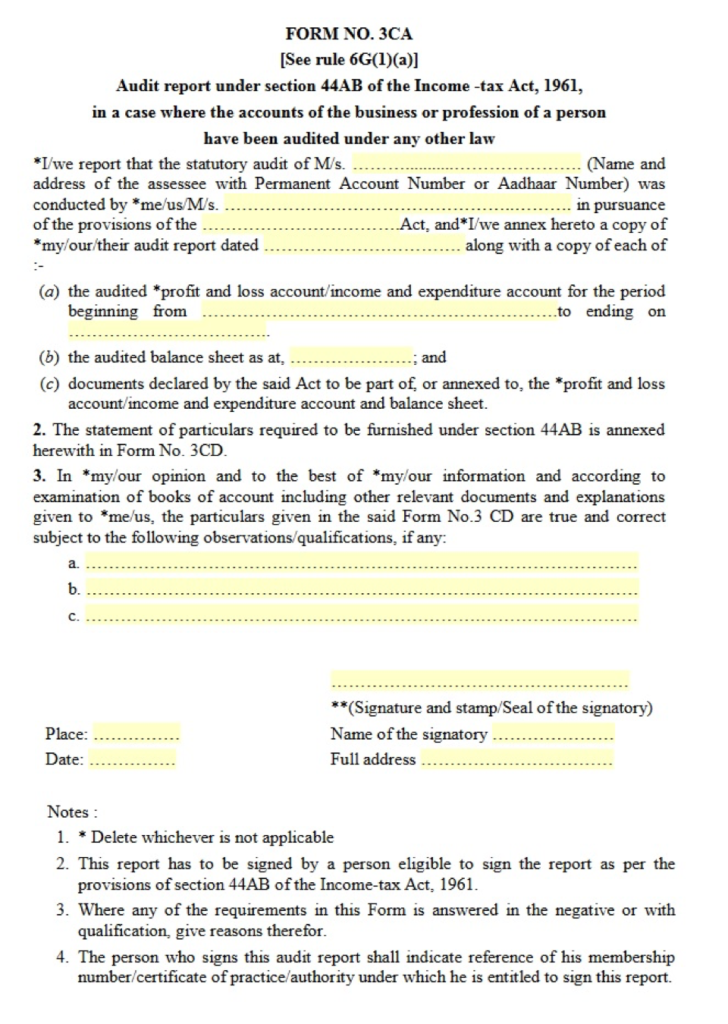

Form 3CA

Tax audit is needed to be filed under this form in case of businesses or professional who needs to get their accounts audited under any other law than income tax act, 1961. For example- All Companies need to file tax audits under Form 3CA as their accounts are audited under Companies Act, 2013.

We need to remember that in either of the conditions, tax auditors must furnish Form 3CD which is a part of the audit report under Section 44AB of Income tax Act.

Details in Form no. 3CA

- Details of the assessee such as Name, Address, PAN etc.

- Date of Audit Report

- Annexure in the form of Audited Balance Sheet, Profit and loss Account, Form 3CD

- A declaration by the auditor that all the details are true to his knowledge

- Audit observations and qualifications found in form 3CD

- Auditor’s name, Membership No, date, FRN No. And signature with seal and stamp

Sample of Form 3CA is as follows:

Form 3CB

Tax audit is needed to be filed under this form in case of businesses or professional who doesn’t need to get their accounts audited under any other law than income tax act, 1961.

We need to remember that in either of the conditions, tax auditors must furnish Form 3CD which is a part of the audit report under Section 44AB of Income tax Act.

Details to be furnished in form 3CD:-

- Details of the assessee i.e. Name, address, PAN;

- Date of the audit report;

- Annexure in the form of Balance Sheet, Profit and Loss Account, Form 3CD

- A declaration by the auditor that all the details are true to his knowledge

- Audit observations and qualifications found in form 3CD

- Auditor’s name, Membership No, date, FRN No. And signature with seal and stamp

- A declaration that the accounts are maintained at the branch and head office

Form 3CD

Form 3CD is a detailed statement of particulars which is needed to fill by the auditor. This form contains fields related to transactions and activities of the business or profession. Form 3CD is filed along both Form 3CA and 3CB for tax audit under Section 44AB of income tax Act 1961.

Form No. 3CD is divided into two parts, Part A and Part B;

- Part A is for basic details about the assessee; and

- Part B is around various compliances under the provisions of Income-tax law

Form 3CE

This form is filed in case of Non-residents or foreign companies who are receiving royalty or fees for technical services from the government or any Indian entity.

Due Date

The due date of filing of the tax audit report is 30th September of the assessment year. For example: For FY2019-20 the due date of filing tax audit report is 30 September 2020.

Penalty

Sec 271B of the Income Tax Act, 1961 prescribes a tax penalty for non-filing of the tax audit report. Such penalty is least of the following:

- 5% of the turnover or gross receipts; or

- 1,50,000

FREQUENTLY ASKED QUESTIONS (FAQs): 44AB of income tax

- Can an internal auditor be appointed as a tax auditor of the Company?

No, an internal auditor can not be appointed as a tax auditor of the company.

- Can I remove the tax auditor as he is submitting an adverse report?

No, you cannot remove a tax auditor if he is submitting an adverse report or on the probability that he is going to issue an adverse report.

- Is tax audit applicable to the sole-proprietorship firm?

Yes, a sole proprietor is required to have a tax audit of his accounts if his annual turnover during the previous year is more than Rs. 1 crore.

- Can I appoint more than 1 tax auditors for my two or more businesses?

Yes, you can appoint more than 2 tax auditors for two or more businesses, or you can appoint one person as a tax auditor for your multiple businesses.

- What are the documents required to be attached to the Tax Audit Report?

Balance sheet, Profit and Loss account, notes to accounts and other reports prepared by the auditor needs to be attached with the tax audit report.

- Can cost auditor conduct the tax audit under Section 44AB of income tax Act 1961?

No, only a full-time Chartered Accountant holding Certificate of Practice can do tax audits.

StairFirst is an e-service platform which provides company registration, corporate compliances, income tax-related and other professional services related to startups / new and old businesses. Contact Us for details